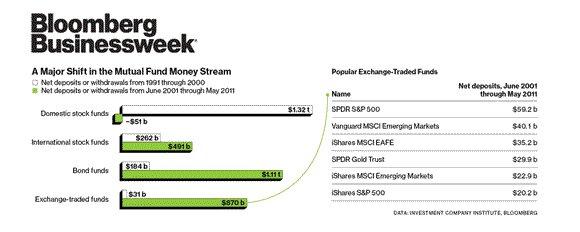

Is it simply a matter of time before ETFs eclipse actively managed mutual funds? Businessweek’s recent article “Americans Lose Faith in Stock Pickers” points to the fierce competition actively managed equity mutual funds are facing from ETFs. Data from the Investment Company Institute referenced in the article shows U.S. equity mutual funds have lost an estimated $8 billion to redemptions year-to-date through the end of June. This puts domestic equity funds on track for their fifth straight year of withdrawals. This is in stark contrast to the staggering ETF inflows we highlighted last week. The below chart from Businessweek clearly shows the remarkable shift away from equity mutual funds and the flow of funds into ETFs:

The flow of money out of mutual funds and into ETFs isn’t just a fad. BNY Mellon recently released a comprehensive report titled ETFs 2.0: The Next Wave of Growth and Opportunity in the U.S. ETF Market which predicts “continued exponential growth” stating that ETF assets will hit $2 trillion before the end of 2015. Strategic Insight, who authored the report, estimates that 20% to 30% of the new flows into ETFs are from assets that would otherwise have been invested in actively managed mutual funds. As with any industry or marketplace, it’s the consumer who filters through the noise and determines which products are the winners and which are the losers. In this case, investors are starting to vote with their own money for ETFs over actively managed mutual funds.