Quarterly Update

Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

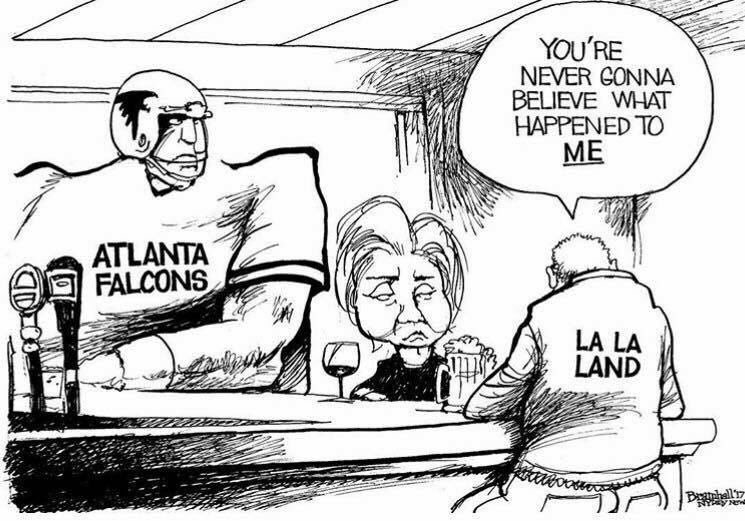

In last quarter’s commentary, we discussed the fallacy of predictions, highlighting the difficult year “experts” experienced in forecasting everything from the Brexit vote to the U.S. presidential election. The conclusion was simply that nobody has a crystal ball. However, the challenges associated with prognostication can actually be taken a step further. In some cases, even when the result of a particular event appears a foregone conclusion, there is still no guarantee as to the end result. Back on February 5th, during Super Bowl LI, the Atlanta Falcons led the New England Patriots 28 – 3 with about six minutes to go in the 3rd quarter. At that exact moment in time, ESPN’s win probability model calculated the Patriots chances of claiming victory at 0.2%! Of course, the Patriots overcame those long odds, winning a game for the ages in epic fashion in overtime. Later in February, during the Oscars, “La La Land” producer Jordan Horowitz actually held a trophy in his hands – unlike the Atlanta Falcons. However, mere seconds later, Mr. Horowitz graciously passed the Oscar statuette to the real winner, “Moonlight” director Barry Jenkins – the result of “Best Picture” award presenter Warren Beatty being given the wrong envelope. The point here is that even if it appears a certain outcome is in the bag, there are still no guarantees.

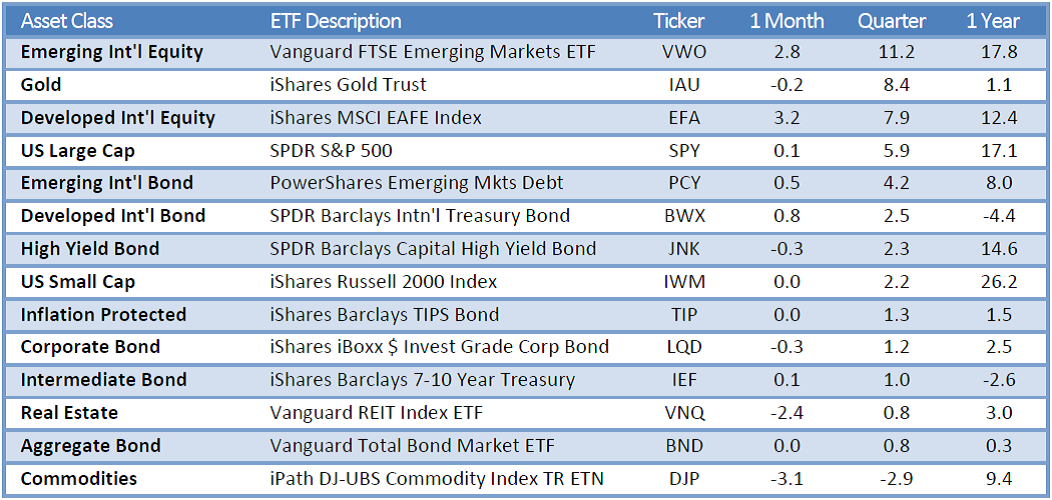

All of which brings us to the events of the first quarter. Fresh off Donald Trump’s equally surprising presidential election victory, economists and market watchers began trumpeting the prospect of accelerating economic growth. President Trump’s pro-growth agenda – infrastructure spending, tax cuts, deregulation, etc. – would lead to a meaningful uptick in everything from jobs to housing to consumer spending. The stock market seemed to agree, with the S&P 500 surging to record highs and volatility running at record lows. As a matter of fact, the first quarter of 2017 marked one of the least volatile periods for the S&P 500 since 1950. Typically, 1% up or down days in the S&P 500 are fairly common, occurring roughly one out of every four trading days. However, from January 1st through March 20th, there were zero such days – and that streak actually extended back to October:

Volatility stems from uncertainty and, at this point, the logical conclusion is there does not appear to be as much uncertainty over Trump’s ability to govern as previously anticipated. As a side note, one of the most prevalent predictions heading into 2017 was that market volatility would spike – this after predictions of economic Armageddon if Trump was elected to begin with. Score another one against prognosticators.

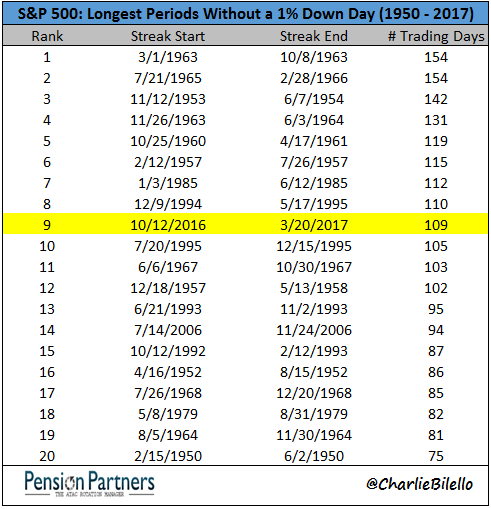

In addition to optimistic economists and a levitating stock market, confidence has surged among consumers and businesses in anticipation of potential economic growth. Many key measures of consumer and business confidence are at multi-decade highs, which makes sense given the characteristic economic positives of infrastructure spending, tax cuts and deregulation. Interestingly, however, there has been a growing disconnect between this consumer and business confidence (soft data) and tangible, hard economic data (i.e. employment, housing, business activity). In other words, the positivity surrounding President Trump’s policies have yet to show up in real economic data.

In many respects, this is not all that surprising. The Trump administration has yet to push through an infrastructure spending bill or tax reform plan, so the impact has not been felt in the broader economy. Also, if and when these come to fruition, the potential benefits may still take time to filter through to the economy – the effects could be more 2018 or 2019 than 2017. In the short-term, there could be some immediate impact – just the anticipation of government spending and tax cuts can help spur consumers and business to spend, knowing better days may be around the corner – but that has yet to be reflected in the data.

All of this is a long-winded way of saying that while there is an abundance of optimism hinging on Trump’s pro-growth agenda, the proof will be in the pudding. While current data and expectations from economists, financial markets, consumers, and businesses point to confidence that Trump will be able to deliver, nothing is assured. Hillary Clinton, the Atlanta Falcons, and the producer of “La La Land” will all attest to the fact that defeat can be snatched from the jaws of victory. President Trump will need to successfully navigate a winding political process to deliver on an agenda the economy and markets now seem to fully expect. It is notable that President Trump has already experienced some of the challenges he will face in governing with his attempt to repeal and replace the Affordable Care Act. Given the highly polarized political environment, pushing through an infrastructure spending package or tax cuts will likely prove equally challenging.

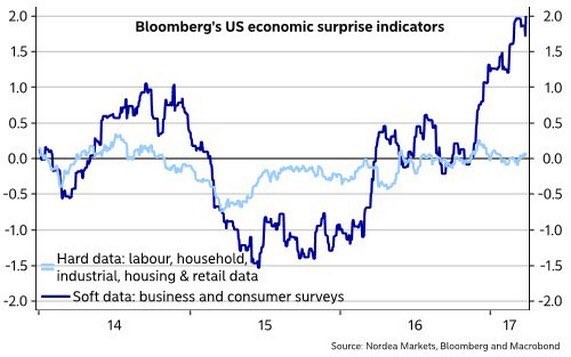

So what is the takeaway for investors? Market returns during the first quarter were strong, driven largely by the aforementioned optimism. If Trump is able to deliver, an intelligent case can be made for further gains. However, if political wrangling devolves into inaction, uncertainty will creep back into the picture and concerns over stock valuations and future economic growth may intensify. If we learned anything from the first quarter of 2017, it is to assume nothing until it is done. Our hope is that politicians will work together to deliver a prosperous future for our country. Beyond that, the current political landscape in the U.S. is yet another reminder of why it is important to diversify internationally. The top performing markets during the first quarter were found outside of the U.S., as overall global economic growth has steadily improved. While attention is naturally focused on U.S. markets and politics, global opportunities are always present and can serve as an excellent diversifier.