Investment Costs: Boring, Confusing, & Absolutely Critical

Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

What gets you more excited? High investment returns or low investment costs? If you are like the vast majority of people, big returns are what really get the juices flowing. We invest our money to earn a return, not to save money on investment costs. At a cocktail party, it is highly unlikely you cozy up to someone and brag, “I just saved 0.5% on my investments!”. That’s a one-way ticket to standing by yourself with a drink in one hand and staring at your phone in the other. The fact of the matter is investment returns thrill and investment costs bore. If something bores us, we tend to ignore it.

Interestingly, outside of investing, we rarely ignore costs. As a matter of fact, most people tend to pay close attention to the money they spend. When shopping for everyday items – groceries, gas, cell phone plans – most people pay at least some attention to costs. I know an executive at a decent sized company who will drive to out-of-the-way gas stations if they can save a few cents on a gallon of gas. I have a rather high-earning friend who diligently clips grocery coupons out of the paper every Sunday and meticulously thumbs through those coupon mailers we all receive. The costs of everyday items add up, so we pay attention.

When it comes to bigger ticket items – TVs, appliances, cars – people tend to pay even closer attention to costs. Have you ever been shopping on Black Friday? People wake up at 4am, wait in long lines, and battle with aggressive shoppers all to save a little money on everything from Fitbits to furniture. In general, the more expensive the item, the more people will comparison shop and negotiate to get the best deal they can. Why is that? Because there is more money at stake. If you think you can save $2,000 on your new car purchase, you will haggle with multiple car dealerships to secure the best deal. You don’t just walk into a store and buy the most expensive TV or pay the sticker price for a new car. You try to find a deal.

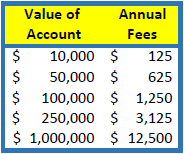

However, when it comes to investment costs, where there is typically even more money at stake, the same behaviors people display when shopping for cable providers or cars seems to go by the wayside. According to the Investment Company Institute, the median cost of an actively managed stock mutual fund, currently one of the most popular investment vehicles, is 1.25% annually. Consider the impact on your investment account:

Keep in mind, these are annual fees – they are charged every single year. Also, the higher the fees you pay, the less money you have to compound over time. In other words, if you can save $500 in annual fees, that $500 is now available to grow over time, year after year. For a $100,000 account, if you could lower your annual fees from 1.25% to 0.25%, you could save $1,000 a year! When was the last time you saved $1,000 on a purchase? Perhaps you waited in one of those Black Friday lines to buy an iPad. Or maybe you saved $5 filling-up a tank of gas or $20 using coupons at the grocery store. Maybe you held off on that glass of wine at the restaurant to save $8 or got rid of some premium channels to save $15 a month on cable. But we are talking $1,000 here!

So why the disconnect?

I think there are several reasons why we pay attention to costs in nearly every other aspect of our lives, but fail to do so with our investments. First, investments do not have readily available price tags like everything else we buy. When you shop for a TV, you can very easily compare the cost of one TV versus another – the price tag is right there. With investments, you may have to do some digging to find the fees. The cynic in me believes that is just the way Wall Street likes it. The more hidden the fees, the easier your hard earned money can be transferred from your pockets to theirs. If the price tag is not right in your face, it is less likely you will consider price when buying investments.

Second, investment costs are automatically deducted from mutual funds and ETFs, which means you never actually see the fees coming out. When you buy a TV, you have to physically swipe your credit card or fork over your cash. You are making a conscious decision to spend your money. With investments, the fees quietly seep out over time. Psychologically, this is an enormous difference. Why do you think federal taxes are withheld from your paycheck each month? It is because the government knows how painful it would be for you to cut a single check every April 15th. Same concept with investment costs.

Lastly, many investors have been led to believe that higher cost equals higher quality – the more you pay for your investments, the better the returns. Across all of the products and services we buy, marketing professionals have spent massive amounts of time and money to ensure we associate higher cost products and services with higher quality. Whether wine, cars, clothes, or electronic gadgets, marketers know exactly how we will respond when presented with two apparently similar options. We tend to think the higher priced options are higher quality. Now, in fairness, there are plenty of examples where higher price does generally equal higher quality – perhaps a five-star hotel or luxury automobile (though, surprisingly, wine isn’t one of them). The saying “you get what you pay for” does have some merit. However, when it comes to your investments, the opposite tends to be true. You get what you DON’T pay for. There is actually an inverse relationship between the costs of your funds and the performance – in other words, the lower the cost of your fund, the higher likelihood of better performance!

So what can you do?

If you invest in mutual funds or ETFs, you are paying an annual fee – something called an expense ratio. When you see “expense ratio”, simply think price or fee. The investment industry has a knack for taking very simple concepts and making them difficult to understand. Expense ratio? Just think price – no different than the prices you see at the grocery store. You can easily find the price of your fund by going to websites like Yahoo Finance, entering the ticker symbol for your fund, and clicking on the profile link. The expense ratio is displayed as a percentage. If you see 0.90%, simply multiply 0.90% by the amount of money you have invested in the fund to find the annual fee (i.e. 0.90% x $100,000 = $900 annual fee). Whether a professional advisor manages your money or you manage your own money, always check investment costs (note that there are other costs besides the expense ratio – loads, 12b-1 fees, commissions, bid-ask spreads, etc). For fun, compare the performance of your fund to its benchmark index as well (which you can also do at Yahoo Finance) – the data tells us that nearly four out of five actively managed funds will underperform.

While the ultimate goal of investing is to generate the required returns for your particular situation, investment costs play a critical role. The higher your investment costs, the higher return you need to overcome these costs. Make a habit of disassociating higher priced funds with higher quality. Most importantly, think about the money you spend for investments in the same way you think about money spent elsewhere – groceries, clothes, entertainment. Most people would not simply throw $1,000 down the drain. You worked hard to save the money in your investment accounts. Make sure you are getting properly rewarded for the money being spent on your investments. While investment costs may be boring and intentionally confusing, lowering costs can lead to more thrilling investment returns, allowing you to be the life of the cocktail party.