ETF Prime Archive

Tackling the Fixed Income Markets with Bond ETFs

Listen to The ETF Store Show every Tuesday at 9am on ESPN 1510 as we cover everything you need to know about Exchange Traded Funds and the world of investing.

On our most recent radio broadcast, we discussed an area of investing that some people may find intimidating or try to avoid altogether – investing in bonds (or fixed income). We explained why fixed income is an important component of a well-diversified portfolio, but also examined how the current interest rate environment is making this endeavor more challenging than ever. Savers using fixed income products are being penalized by the low rates and those individuals who rely on fixed income to cover day-to-day expenses are being forced to lower their standard of living. To that end, given the historically low interest rates, we debated whether we’re currently in a bond bubble and if so, what that means for the fixed income portion of your portfolio. We also discussed the inherent challenges investors face when trying to select individual bonds or invest in actively managed fixed income mutual funds.

More importantly, we explained why we believe ETFs are the best way for investors to access the fixed income markets. Bond ETFs can provide broad exposure to a wide range of fixed income markets around the globe and do so extremely efficiently and cost effectively. We discussed some specific bond ETFs that you might consider as part of the foundation for the fixed income portion of your portfolio including tickers BND, TIP, and MUB. And, as always, we delivered our weekly market update and ETF Spotlight (ticker PCY). Listen to the full show here to learn more about investing in bond ETFs.

Podcast: Play in new window | Download

Tackling the Fixed Income Markets with Bond ETFs

Podcast: Play in new window | Download

Are You Still Investing in Mutual Funds?

Podcast: Play in new window | Download

Could 401k Fees Cut Your Investment Returns By a Third?

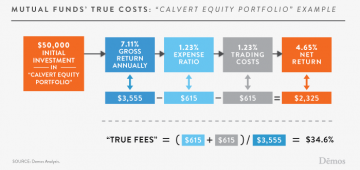

That’s the conclusion from research group Demos, a multi-issue national organization who seeks to advocate change in various public matters. According to their research, a dual income household where each individual earns the median income and contributes to their 401k will pay an average of $154,794 in 401k fees and lost returns. For a higher income (defined as being in the top 25%) dual-earner household, Demos calculated the fees would run a staggering $277,969!

So, what’s driving these astronomical costs? Demos focused on two fees in particular:

- Expense Ratios on Funds – these are the fees that investors pay to fund companies to cover the management, marketing, and administration of the funds. For example, in Demos’ research, the median expense ratio of mutual funds in 401k plans was 1.27%.

- Trading Fees – these are the costs incurred by funds to buy and sell the securities that comprise the funds. Demos estimated these to run approximately 1.2%.

Demos included a nice chart depicting these fees (note that Demos uses a 7% return, the average long-term mutual fund return before fees according to their research):

What may be even scarier to 401k participants is that Demos’ research doesn’t even include all of the other expenses associated with the typical 401k plan – costs like plan record keeping fees and plan administrative fees. At The ETF Store, we’ve talked for years about the significant negative impact that fund fees can have on long-term investment performance. That’s why we use ETFs in our client portfolios. ETFs are typically far cheaper than actively managed mutual funds. And that’s not even factoring in the underperformance of actively managed mutual funds.

The ETF Store offers businesses an ETF-focused 401k platform that’s designed to reduce costs, increase transparency, and increase investment options within the plan – all of which can help employees become retirement ready. Asking hard working employees to sacrifice 30% of their investment returns so some overpaid money manager can buy a Porsche sounds egregious and unnecessary to us.