ETF Prime Archive

The Mutual Fund Way – Pay a Lot, Get a Little

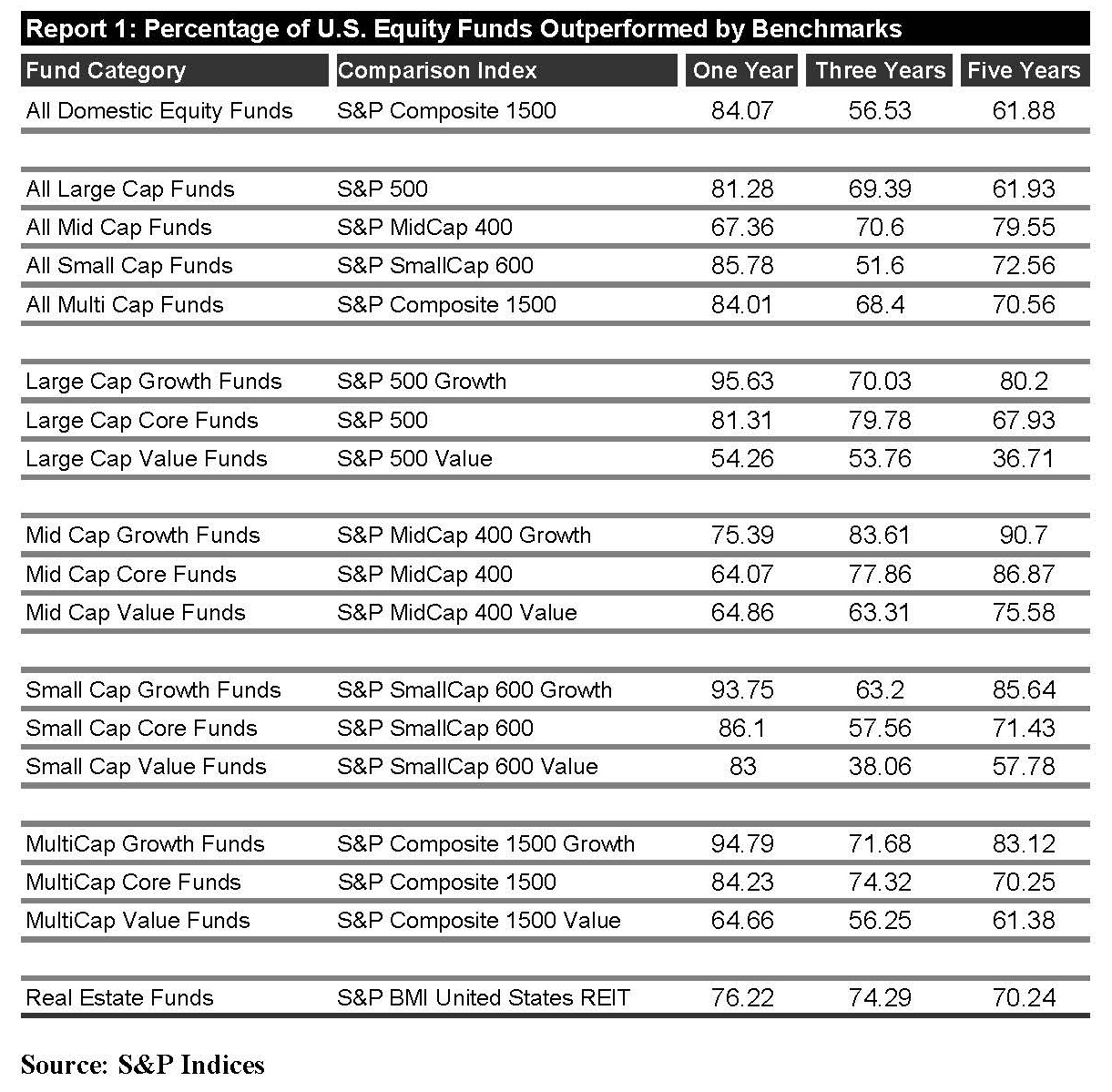

If you’ve been following our commentary, whether through our blog or on our radio show, you know that a favorite subject of ours is the underperformance of actively managed mutual funds. In case you missed it, approximately 84% of actively managed US equity mutual funds underperformed their relative S&P benchmark in 2011. That’s right – 84%! Over the past three and five years, 56% and 61%, respectively, of actively managed US equity mutual funds have underperformed their benchmark. Here’s a full chart of the carnage from SPIVA:

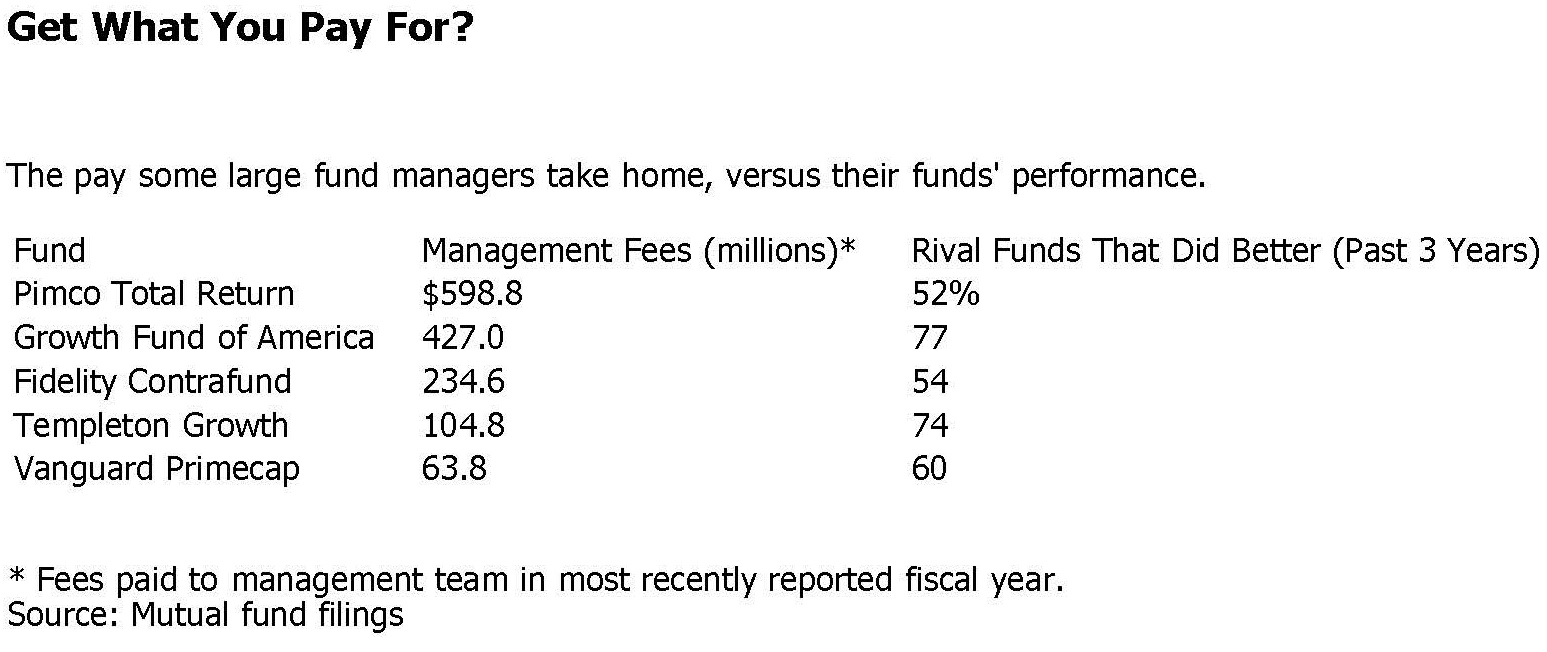

But wait, it gets worse. Not only do investors get this severe underperformance with actively managed mutual funds, but they also get to overpay for this gross underperformance. A recent article from smartmoney.com provided an excellent graphic depicting this. The below chart from the article shows the money that five of the largest mutual funds out there is raking in from investors and more importantly, how these funds are performing (or not) relative to their competition:

How ETFs Can Make Tax Day More Pleasant

Listen to The ETF Store Show every Saturday at 4pm on KCMO Talk Radio 710AM as we cover everything you need to know about Exchange Traded Funds and the world of investing.

On our most recent radio broadcast, with tax day 2012 looming, we explained how ETFs can reduce your tax bill. Because of their legal structure and minimal trading, ETFs typically distribute very little, if any, capital gains to investors. In contrast, many mutual funds distribute capital gains – sometimes even if the mutual fund is down for the year!

So, why is this case? Take the following example: Let’s say there’s a mutual fund shareholder that wants to sell their mutual fund shares because they need cash to buy a house. The mutual fund manager may need to sell shares of stocks held by the fund to raise cash to meet this shareholder redemption request. When the mutual fund manager sells shares of stocks owned by the fund for a gain, the mutual fund is required to distribute those gains to all mutual fund shareholders. So to recap, if you’re a shareholder of the mutual fund and another shareholder redeems their mutual fund shares, you may be penalized with a taxable capital gain distribution even though you didn’t do anything. That hardly seems fair. And what’s worse, these capital gain distributions are “phantom gains” in that the share price of a mutual fund is reduced by the amount of the capital gain distribution. So net-net, shareholders haven’t gained anything other than a tax bill.

Contrast that with ETFs where a shareholder wanting to raise cash can simply sell their shares on the stock exchange with no impact to you. There are instances where ETFs may reconstitute or rebalance holdings, thus generating a capital gain distribution, but those instances are rare. Recent data from Morningstar on capital gain distributions showed that over the last five years, looking at the large blend fund category, active mutual funds paid out capital gain distributions equal to 1.92% of the fund value while ETFs paid out 0%. That’s a big difference come tax time.

We also discussed tax loss harvesting strategies with ETFs and talked about some portfolio construction considerations when using exchange traded products. Listen to the full show here to learn more about reducing your taxes by using ETFs.

Podcast: Play in new window | Download

How ETFs Can Make Tax Day More Pleasant

Podcast: Play in new window | Download

Shed Your Expensive Mutual Funds

Listen to The ETF Store Show every Saturday at 4pm on KCMO Talk Radio 710AM as we cover everything you need to know about Exchange Traded Funds and the world of investing.

On our most recent radio show, we discussed the importance of minimizing your investment costs and explained why, unfortunately, many brokers are effectively incentivized to push expensive mutual funds in your portfolio. An easy way to combat these commissioned brokers, many of whom are more concerned about their financial future than yours, is to use an independent Registered Investment Advisor (RIA) who uses passively managed investments such as ETFs. The ETF Store can be the alternative to your money-grabbing broker – we’re an independent, fee-based RIA that focuses on building highly diversified, low cost portfolios using ETFs.

We encourage everyone to call their advisor today and have them explain to you exactly what you’re paying for your investments and their investment advice. You might be unpleasantly surprised at what you find out. Learn more about how to reduce your investment costs by listening to our full show here.

Podcast: Play in new window | Download