Nate Geraci

August 8, 2011

Gold continued its steep upward ascent today as the price per ounce soared past $1,700 after the downgrade of US sovereign debt by Standard & Poor’s. With growing concern that the US may be headed towards another recession and the continued uncertainty in Europe and the global economy in general, gold has become a “safe haven” for investors nervous about investing in equities, currencies, or just about anything. In particular, the continued decline in the US dollar and, to an extent, the Euro, has helped propel the shiny metal to record highs.

The US dollar is likely to continue to come under pressure due to a combination of continued low interest rates in the US – kept artificially low by the US Federal Reserve (which makes other currencies with higher rates more attractive to investors), a mounting US government deficit and national debt burden, and slowing US economic growth (investors are more attracted to countries with more robust growth). The recent wrangling over the US debt ceiling put additional pressure on the dollar.

The Euro has a number of countries in dire financial straits (Portugal, Ireland, Italy, Greece and Spain, affectionately named the PIIGS) which could cause a financial crisis in the EU. Gold, in a sense, is becoming a currency replacement for the dollar and the Euro. Gold is also a hedge against inflation and a number of areas around the globe are seeing rising inflationary pressures which have increased global demand for gold. Finally, Chinese consumers as well as consumers in other BRIC and emerging countries are starting to buy more gold as an investment, not to mention the fact that Central Banks around the globe are becoming significant net buyers of gold.

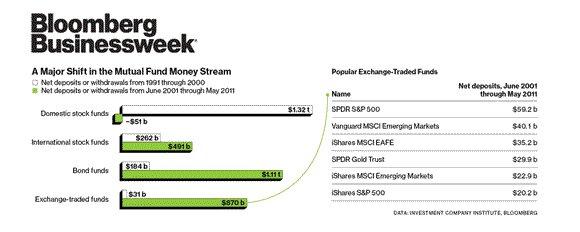

With gold continuing to hit record highs, investors are becoming increasingly aware of the benefits of having gold in their portfolios. ETFs are one of the cheapest and most convenient ways for investors to access gold. Two ETFs that provide indirect ownership of the commodity itself, SPDR Gold Shares (GLD) and iShares COMEX Gold Trust (IAU) are the largest ETFs of their kind and are essentially the same ETF; both take physical ownership of gold bullion and a share of each represents a defined percentage of that gold.

With all of the uncertainty in the markets, gold has again proven itself to be an investment alternative worth looking at. Investors would be wise to consider the diversification benefits of including gold as part of their overall portfolio. At The ETF Store, we’ve been consistent in our belief that there’s a place for gold in investment portfolios and believe ETFs are the best way to access gold exposure.