ETF Radio Show

Happy 20th Birthday, ETFs!

Listen to The ETF Store Show every Tuesday at 9am on ESPN 1510 as we cover everything you need to know about Exchange Traded Funds and the world of investing.

Click here to listen to The ETF Store Show now.

On our most recent radio broadcast, we celebrated the 20-year anniversary of the launch of the first ever U.S. listed exchange traded fund – the SPDR S&P 500 ETF (ticker SPY). While many investors tend to view ETFs as a relatively new innovation, ETFs have actually been around for twenty years thanks to the largest and most popular ETF, SPY, which was created on January 22nd, 1993. Since that time, ETFs have grown into a $1.4 trillion monster with no signs of slowing down. Stoyan Bojinov from ETF Database joined us on the program to offer his thoughts on “ETFs at 20” and also discuss what lies ahead for the industry over the next twenty years. We explained how SPY really encapsulates why investors are gravitating towards passively managed ETFs, while at the same time shunning actively managed mutual funds – namely because ETFs tend to be cheaper, more tax efficient, offer greater transparency, and can minimize the risk of underperformance that has plagued so many actively managed mutual funds. We also discussed an excellent interactive tool that ETF Database created in honor of the 20-year anniversary of SPY which shows the top ten components of the S&P 500 index going all the way back to 1980. While the chart is certainly a stroll down memory lane, it can also offer some very important investing lessons as we described on the show.

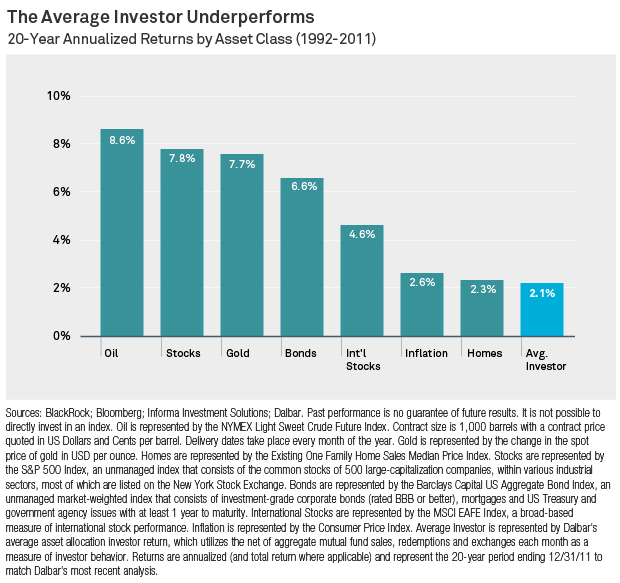

In our weekly market update, we discussed some of the highlights from our recently released quarterly market commentary including our outlook for global equities and why individual investors have essentially underperformed every major asset class over the past twenty years. Finally, in our ETF spotlight segment, we examined a country specific ETF, the SPDR S&P China ETF (ticker GXC), and explained where China might fit in your investment portfolio.

Emotional Investing Leads to Underperformance

Blackrock recently conducted a very interesting study whereby they examined 20-year investment returns for the average investor. The results were not good. Over a 20-year period from 1992 – 2011, the average investor underperformed every single major asset class. Here are the numbers:

The primary reason for this disastrous performance by individual investors is reacting emotionally to volatility in the financial markets. Financial markets have always been, and will always be, volatile. This chart underscores the importance of having a financial advisor. A financial advisor can help you develop a long-term investment plan and provide that objective, unemotional voice of reason during those periods of volatility to help you avoid the common pitfalls that befall the average investor. At The ETF Store, we’re here to help implement the right investment plan for you and our disciplined strategies can take the emotion out of investing. Don’t be an average investor.

We Talk SPDR ETFs with SSgA’s David Mazza

Podcast: Play in new window | Download