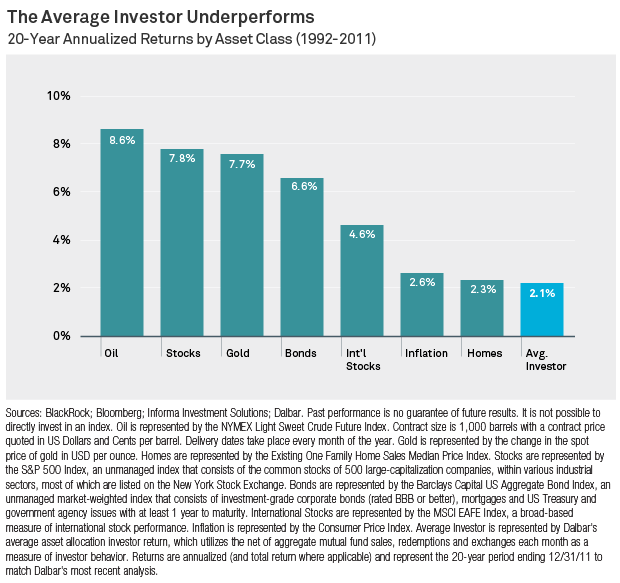

Blackrock recently conducted a very interesting study whereby they examined 20-year investment returns for the average investor. The results were not good. Over a 20-year period from 1992 – 2011, the average investor underperformed every single major asset class. Here are the numbers:

The primary reason for this disastrous performance by individual investors is reacting emotionally to volatility in the financial markets. Financial markets have always been, and will always be, volatile. This chart underscores the importance of having a financial advisor. A financial advisor can help you develop a long-term investment plan and provide that objective, unemotional voice of reason during those periods of volatility to help you avoid the common pitfalls that befall the average investor. At The ETF Store, we’re here to help implement the right investment plan for you and our disciplined strategies can take the emotion out of investing. Don’t be an average investor.