Listen to The ETF Store Show every Tuesday at 9am on ESPN 1510 as we cover everything you need to know about Exchange Traded Funds and the world of investing.

Click here to listen to The ETF Store Show now.

On our most recent radio broadcast, we discussed one of the primary reasons why we believe investors continue to place record amounts of money into ETFs – mutual fund underperformance. The majority of mutual funds are actively managed. In other words, investors pay to have a fund manager attempt to select the securities that the mutual fund invests in, with the hope that these securities can “beat” the relevant market. This is in contrast to the majority of ETFs which simply track a passive index. Unfortunately for actively managed mutual funds, they would be much better off going the passive route according to the latest data from S&P Dow Jones Indices.

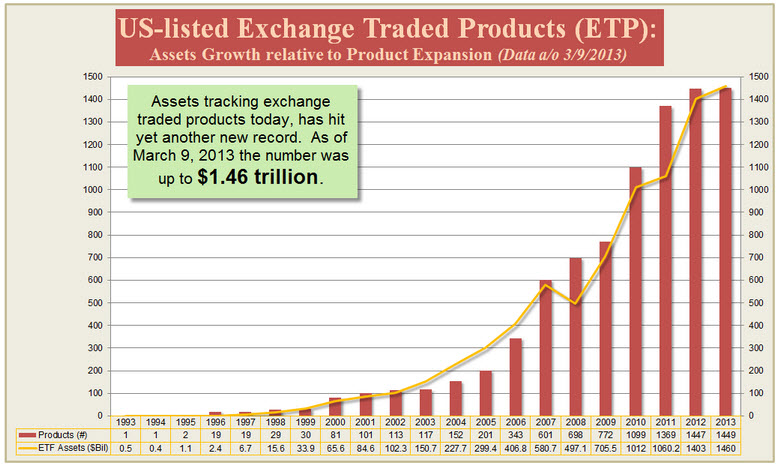

S&P Dow Jones Indices puts together something called the SPIVA Scorecard. This scorecard captures the performance of actively managed mutual funds versus their benchmark indexes (the same benchmark indexes that many ETFs track). The underperformance is staggering. Through the end of 2012, over the past five years, nearly 69% of domestic equity funds underperformed their benchmark. Close to 74% of international mutual funds did the same. Bond mutual funds were even worse as nearly 94% of government long funds and 95% of high yield funds underperformed their benchmarks. It’s no wonder that investors are flocking to mostly passively managed ETFs and driving an industry growth chart that looks like this (source: http://alletf.com/content/exchange-traded-assets-update-march-2013):

Making matters worse for mutual fund investors is that they typically have to pay much higher fees for this underperformance (though, it should be noted that these high fees are more often than not the culprit of this underperformance). The average actively managed domestic equity mutual fund will cost investors around 1.4%. Compare that to an ETF such as the Vanguard Total Stock Market ETF (ticker VTI), which we highlighted on the show. VTI costs a mere 0.06% and offers investors exposure to the same domestic equity market that these actively managed mutual funds are having such a difficult time beating.

In our weekly market update segment, we offered a crash course on the Cyprus banking crisis and explained why the financial markets care about what happens in this tiny island country. Financial media outlets have been in full overdrive reporting on the events in Cyprus, which has spooked some investors. We cut through the noise and explained exactly what’s going on and the potential impact it could have on your investments.