Welcome to the ETF Prime Podcast

One of the “most helpful plain-English resources for investors who want to demystify exchange-traded funds” – Bloomberg Businessweek

Latest Episode

Early Grades on 2026 ETF Predictions & Key Market Themes to Watch

Cinthia Murphy, Investment Strategist at VettaFi, delivers early grades on host Nate Geraci’s five ETF predictions for 2026. Matt Bartolini, Global Head of Research Strategists at State Street Investment Management, shares three key ETF and market themes on his radar.

About the Podcast

ETF Prime is hosted by Nate Geraci. Learn how to make ETFs a part of your investment portfolio as Nate spotlights individual ETFs and interviews experts from across the country. ETF Prime is available on Apple Podcasts, Android, Spotify, and most other major podcasting platforms. Specific guest interviews can be accessed by visiting the ETF Expert Corner.

Recent Episodes

Disruptive Innovation

Bond ETFs recently turned fifteen years old. Nate & Conor explain how, while bonds may not be the most exciting aspect of your portfolio, ETFs have completely disrupted the status quo of investing in them. Cathie Wood, Founder & CEO of ARK Invest, spotlights the ARK Innovation ETF (ARKK) and the ARK Web x.0 ETF (ARKW), and offers her perspective on Bitcoin, Amazon, and Tesla.

Podcast: Play in new window | Download

3 Ways ETFs Have Revolutionized The Bond Market

The following was authored by Matthew Tucker, Head of iShares Americas Fixed Income Strategy.

Fifteen years ago this week the first bond exchange-traded funds (ETFs) debuted, changing the way investors can access fixed income markets. At first, only four iShares bond ETFs were available, with just a small amount of assets and access limited to Treasuries and U.S. investment grade credit. Today there are over 300 bond ETFs in the U.S. with more than $500 billion in total asset under management (AUM), offering entry into almost every sector of the bond market (source: BlackRock and Bloomberg, as of 6/30/2017).

What brought about this exceptional growth? Quite simply, ETFs have modernized fixed income markets. They can help make it easier for both retail and institutional investors to invest in bonds, potentially gain liquidity and add specific exposures to portfolios.

Total assets under management for bond ETFs (U.S. total)

Easy access to bonds

Traditionally, the over-the-counter nature of the bond market favored larger, more sophisticated investors—size and scale mattered in everything from trade execution to getting allocations for new issues. Bond ETFs help level the playing field. They enable investors to efficiently access fixed income markets on demand. With a single ticker, an investor can tap into thousands of bonds in a specific sector without having to hunt for inventory or navigate multiple offers from multiple brokers. Bond ETFs have democratized access to this marketplace. An individual investor in Kansas can trade bond ETFs on a stock exchange in the same way as a hedge fund manager in New York would.

Ease in trading in and out of bond ETFs

The liquidity offered by bond ETFs is another reason for the market’s remarkable growth. Most bonds trade over the counter, while bond ETFs trade on the exchange. Exchange trading creates liquidity and allows for bond ETFs to be used to manage risk and adjust market exposure. In their 2016 U.S. Bond ETF Study Greenwich Associates noted that 71% of surveyed institutional investors have found that the trading, sourcing and liquidity of fixed income securities have become more challenging over the last three years. About 85% of institutions that invest in ETFs said that they use bond ETFs due to their liquidity and low trading costs. (Source: Greenwich Associates. ETFs: “Active” Tools for Institutional Portfolios, 2017. This study was sponsored by BlackRock.)

Why are bond ETFs more liquid than individual bonds? Because the over-the-counter bond market can be very illiquid. Not every bond trades everyday, based on comparing 30-day trading data from TRACE to broad Bloomberg and Markit bond market indexes as of 6/30/2017. For those investment grade and high yield bonds that are considered liquid, represented by constituents in Markit iBoxx $ Liquid Investment Grade and High Yield Indexes, they only trade 3-4 times per day on average. By comparison, bond ETFs trade at significantly higher frequency. For example, iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), an investment grade ETF, trades 14,000 times a day. iShares iBoxx $ High Yield Corporate Bond ETF (HYG), a high yield ETF, trades 32,000 times a day. (Based on 30-day trading data from BlackRock, Bloomberg, TRACE and Markit iBoxx, as of 6/30/2017).

Bond ETFs add incremental liquidity to the bond markets by allowing investors to trade shares on an exchange. Investors are effectively trading portfolios of bonds at a visible price on the exchange, and most of these transactions do not involve any actual bonds being traded. Bond ETFs allow investors to access bonds the same way they can access stocks.

Express views with precision

Before ETFs, many investors relied on active mutual funds or individual securities for access to the bond market. They had to know the ins and outs of security selection (e.g. credit research, issuer analysis), or find an active manager with their same view on the market.

Now investors can use bond ETFs to build model portfolios, follow asset allocation guidance, or express their own tactical views, all in a low-cost manner. Bond ETFs have put investors back in the driver’s seat. An investor can take control of their portfolio risk by using bond ETFs that seek to track an index. For example, investors seeking exposure to investment grade bonds know that an index investment grade bond ETF will only hold these bonds, and won’t dip into high yield securities. Investors knows what they are invested in—and what they won’t be invested in down the road.

With 15 years of history, bond ETFs have weathered the global financial crisis, quantitative easing and several rounds of interest rate hikes. Even with the $700 billion in assets today, bond ETFs represent less than 1% of the global bond markets (source: SIFMA and Bloomberg, as of 6/30/2017). If the growth in equity ETFs were any indication, bond ETFs could continue to grow at double digits and reach $2 trillion in the next 15 years.

For investors who are looking to get started with bond ETFs, consider a broad fund like iShares Core U.S. Aggregate Bond ETF (AGG) or iShares Core Total USD Bond Market ETF (IUSB). Investors who are more interested in building a custom portfolio, the Core Builder Tool on iShares.com can help.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog. Karen Schenone, CFA, is a Fixed Income Product Strategist and contributed to this post.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Additional information on the differences between ETF and mutual funds may be found here.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Diversification and asset allocation may not protect against market risk or loss of principal.

Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

Investment comparisons are for illustrative purposes only. To better understand the similarities and differences between investments, including investment objectives, risks, fees and expenses, it is important to read the products’ prospectuses. Certain traditional mutual funds can also be tax efficient.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This post contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

No proprietary technology or asset allocation model is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the Core Builder Tool will be successful.

©2017 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Can the Color Red Alter Your Investment Behavior?

A recent Wall Street Journal article highlighted research showing that the color red can actually alter your investment outlook. Nate & Conor explain how this is yet another example of ingrained behaviors and biases potentially impacting your investment returns. Greg King, Founder & CEO of Rex Shares, spotlights one of the top performing ETFs year-to-date, the Rex VolMaxx Short VIX Weekly Futures Strategy ETF (VMIN), and discusses the need for education around VIX-related ETFs.

Podcast: Play in new window | Download

Are ETFs the Tail Wagging the Stock Market Dog?

With ETFs raking-in billions of dollars in new investor money, some are asking whether ETFs are now driving the stock market versus the other way around. Nate & Jason explore whether ETFs are really “the tail wagging the dog”. Will Rhind, Founder & CEO of GraniteShares, spotlights two recently launched commodity ETFs, including the lowest cost, broad-based commodity ETF on the market.

Podcast: Play in new window | Download

Are You a Glass Half Empty or Glass Half Full Investor?

Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

A noteworthy story from the first half of 2017 was the historically low volatility in the stock market. Considering the never-ending litany of stories on President Trump, the Federal Reserve, and concerns over North Korea, Russia, and Syria, you might have expected a more turbulent ride for stocks. However, volatility was nowhere to be found. As we mentioned in last quarter’s commentary, 1% up or down days in the S&P 500 have historically been fairly common, occurring roughly one out of every four trading days. Thus far in 2017, the S&P 500 has produced just four moves greater than 1%, the fewest since 1964.

Depending upon your view of the markets, it is likely you interpret this lack of volatility in one of two ways. If you are a glass half empty investor, this is the calm before the storm. With uncertainty over what the Trump administration may or may not be able to accomplish (tax reform, infrastructure spending, etc), along with ambiguity over Federal Reserve policy and geopolitical tensions, the lack of volatility is disconcerting. Combine that with S&P 500 stock valuations appearing stretched and the continuing debate over the health of the U.S. economy, and glass half empty investors are already nervously preparing for the next bear market.

Glass half full investors interpret low volatility as evidence of a near-goldilocks environment – not too hot, not too cold, but just right. The first half of 2017 was close to perfection for these investors. The S&P 500 gained over 9%, bonds produced positive returns across the board, and volatility was absent. All of this amid a backdrop of historically low interest rates, low inflation, corporate earnings growth, a strong housing market and unemployment at its lowest level in over 16 years.

Concerns over politics, the Fed, and international conflicts are easier to brush aside when the preponderance of the evidence points to a healthy economy and the stock market continues to rise. As a matter of fact, according to Goldman Sachs, in the last 14 similar low volatility periods since 1928, it has typically taken a significant catalyst such as war, terrorist attacks, or an economic recession to cause a spike in volatility. With no such catalyst appearing eminent or predictable, glass half full investors have chased away glass half empty investors so far this year.

So what does this mean?

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap).” – Benjamin Graham, The Intelligent Investor

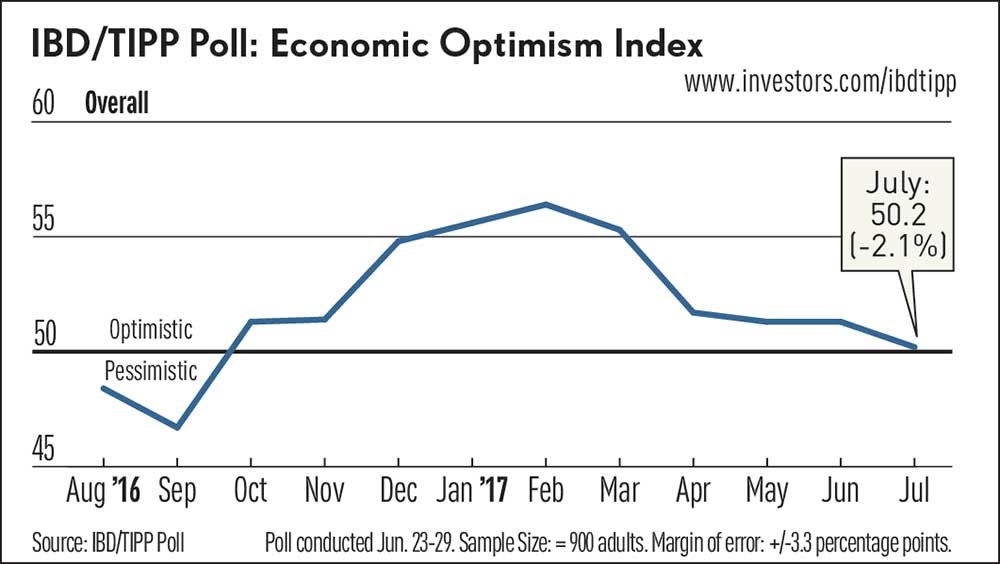

In investing, most everything can be viewed through either an optimistic or pessimistic lens. Each of us has been colored by our past market experiences – both positive and negative – which have influenced how we currently perceive the market. But perception is not always reality. While Benjamin Graham is correct that the market is a swinging pendulum, investors’ ability to determine the current position of the pendulum is limited at best. While trending down, one recent measure of how confident consumers, workers and investors are in the pace and direction of the U.S. economy is neutral – hardly unsustainably optimistic or unjustifiably pessimistic.

To ensure your past stock market experiences do not negatively impact your future investment returns, a useful exercise is to consider outcomes contrary to your belief system. For glass half empty investors, ask yourself how you will react if stocks go up another 25 – 30% from here? For glass half full investors, consider what you will do if stocks crater 25 – 30%? Your answer to these questions may help quell an unnecessarily bearish outlook or tame a euphorically bullish viewpoint. At the end of the day, maintaining a realistic, balanced perspective on the market and keeping emotions in check tends to lead to investing success.

“If we talk about the glass being half empty or half full, I want to know what does the glass look like from underneath the table?” – Brad Thor, #1 New York Times bestselling author

The fact is, significant market moves tend to occur when investors least expect them to occur. Market volatility, the news cycle, and even stock valuations rarely serve as accurate buy/sell signals. At The ETF Store, instead of viewing the glass as half empty or half full, we look at the glass from many different angles. Considering a wide range of outcomes – both good and bad – helps us keep an even keel. Our portfolio strategies are built to react properly to the expected and to weather, or potentially even withstand, the unexpected. Whether you are a glass half empty or glass half full investor today, it is our job to ensure your financial success and a full glass down the road.