Welcome to the ETF Prime Podcast

One of the “most helpful plain-English resources for investors who want to demystify exchange-traded funds” – Bloomberg Businessweek

Latest Episode

Early Grades on 2026 ETF Predictions & Key Market Themes to Watch

Cinthia Murphy, Investment Strategist at VettaFi, delivers early grades on host Nate Geraci’s five ETF predictions for 2026. Matt Bartolini, Global Head of Research Strategists at State Street Investment Management, shares three key ETF and market themes on his radar.

About the Podcast

ETF Prime is hosted by Nate Geraci. Learn how to make ETFs a part of your investment portfolio as Nate spotlights individual ETFs and interviews experts from across the country. ETF Prime is available on Apple Podcasts, Android, Spotify, and most other major podcasting platforms. Specific guest interviews can be accessed by visiting the ETF Expert Corner.

Recent Episodes

Investment Implications of the Presidential Election

Nate & Jason provide historical context around presidential elections and stock market reactions over the short and long-term. Tushar Yadava, Investment Strategist at iShares, offers perspective on potential investment implications of the upcoming election and spotlights the iShares Edge MSCI Min Vol USA ETF (USMV).

Podcast: Play in new window | Download

The Simple, Straightforward, and Nearly Foolproof Approach to Investing

The following was authored by Bill McNabb, chairman and chief executive officer of Vanguard.

If you think you’ve had reason to feel uneasy about the investment environment lately, you’re not imagining things. In just the past few months, we’ve seen economic uncertainty, intense political polarization, and super-low bond yields. Yet at the same time, the stock market kept pushing higher.

In this confusing and sometimes contradictory climate, you may be asking yourself a question that I hear often: How do I make sense of all this, keep investing, and still get a good night’s sleep?

As with any problem, there are multiple ways to go at it. But there’s one approach in particular that is simple, straightforward, and nearly foolproof: Save more money. Not only can saving more give you a greater sense of control over your investment plan, it can help compensate for long-term returns that, in our estimation, could fall short of historical averages.

I love the way one of our investment pros put it. This summer, Fran Kinniry told The Wall Street Journal, “Investing is always a partnership between you and the markets.” He explained that the markets carried more than their fair share of the weight for a couple of decades, through the 1990s, providing outsized returns that made the investor’s half of the partnership relatively light work. “But now you are going to have to be the majority partner.”

Sobering? Sure. Hopeless? Definitely not

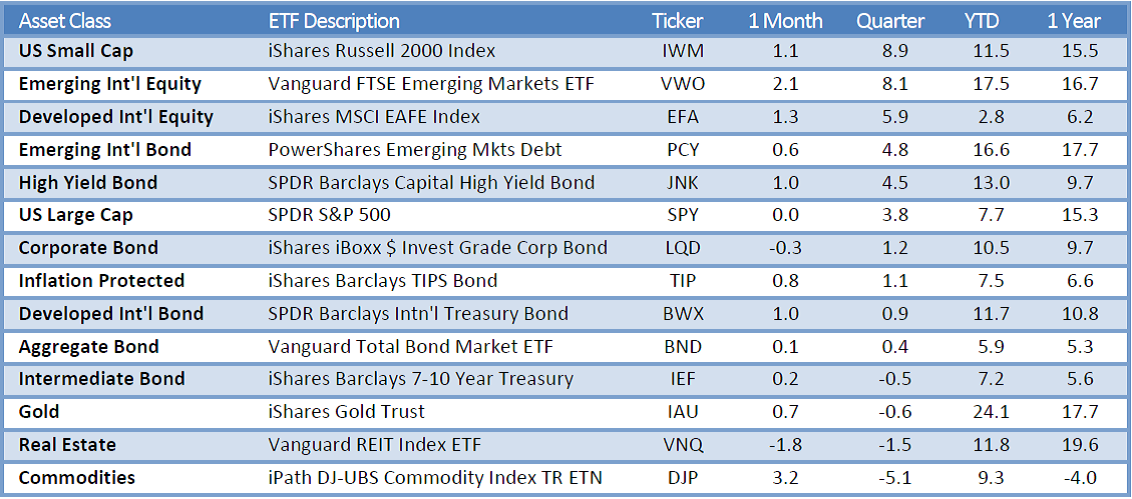

Over the 12 months since last September, U.S. stocks returned 15%, though the rise has not been a one-way ticket straight up. International markets have also posted strong returns, but lower than those of the broad U.S. market. In June, the decision by United Kingdom voters to exit the European Union came as a surprise but caused market heartburn for only a few days.

In fixed income, yields remained extremely low—about 1.60% on the 10-year U.S. Treasury note at the end of September, after dipping below 1.40% over the summer. And bond yields in some international markets were negative.

Even this relatively small window of time illustrates a truism of the financial markets: There will always be segments that perform well and others that don’t. Saving more saves you from trying to control the uncontrollable—how economies and the markets perform. And it keeps you in control of one of the most vital parts of your investment program.

Although the “save more” logic is easy to grasp, it’s not always easy to follow. Bills, illness, the loss of a job—these can affect any of us.

But whatever our circumstances, figuring out how to save more is worth the effort. It requires that we make difficult decisions to forgo some consumption today to increase the likelihood of consuming (or consuming more) in the future. This is the very heart of investing. Sacrifices are never fun, so consider carrying them out systematically and in doses that you can be comfortable with—for instance, gradually getting up to the max in your IRA, or adding a percentage point or so to the amount you stash in your employer’s retirement plan. As a point of reference, we generally suggest that investors strive for a retirement savings rate of 12%–15%, including any employer contributions.

If you need more convincing about the wisdom of the “save more” course of action, it might be helpful to examine your alternatives. This list is by no means exhaustive, but it hits on a few of the big ones, and none are without risk.

– Reach for yield. With yields so low on many types of bonds, it’s tempting to find corners of the fixed income market where payouts are juicier. But with the juice comes considerable risk. You need to be aware that you’d be taking on more risk—and how much more.

– Go all-in on a hot-performing asset class or fund. (By now, you know better than that, right?)

– Sit tight. This approach isn’t a terrible idea; it’s better than panicking and deciding to just “do something,” particularly if that means changing your approach in response to the market’s movements.

Here’s the inescapably challenging part of your partnership with the markets: In the short run, your “partner” is fickle, emotional, and wildly unpredictable. But in the long run, your partner is mostly rational and extremely helpful.

The best way to minimize your vulnerability to the market’s mood swings, and to maximize the benefit of your partner’s longer-term strengths, is to expect less and save more. Maybe the markets will deliver better-than-expected returns. Maybe they’ll be consistent with our more modest expectations. In either case, a higher savings rate can help put you in a better position to reach your goals.

ETFs to Reach $10 Trillion by 2020?

The game-changing DOL fiduciary rule has led to a prediction of ETF assets reaching $10 trillion by 2020. While the shift towards ETFs has been well underway for years, Nate & Conor discuss how an intensifying focus on investment costs will further impact both fund companies and investors. Rob Bush, ETF Strategist with Deutsche Asset Management, explains multi-factor investing and spotlights the Deutsche X-Trackers Russell 1000 Comprehensive Factor ETF (DEUS).

Podcast: Play in new window | Download

Dept of Labor Fiduciary Rule Accelerates ETF Price War

With iShares and Charles Schwab recently cutting fees on several key ETFs, Nate & Jason explain why the Department of Labor’s fiduciary rule is accelerating an ETF price war. Eric Ervin, President & CEO of Reality Shares, explains the concept of dividend growth investing and spotlights the Reality Shares DIVS ETF (DIVY).

Podcast: Play in new window | Download

Quarterly Update

Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” – Sir John Templeton

Between the contentious presidential election, negative discourse surrounding Federal Reserve monetary policy, lack of corporate earnings growth, Deutsche Bank’s financial struggles, Syria’s civil war – the list goes on and on; market sentiment is short on optimism and long on pessimism. Recent headlines include:

- “Donald Trump on the stock market: ‘It’s all a big bubble” – CNBC

- “Mark Cuban: ‘Huge, huge’ losses for stocks if Trump wins” – CNN

- “Fed holds fire on rates, avoids stock market shock” – USA Today

- “Deutsche Bank crisis threatens to roil global markets” – MarketWatch

Yet, because of, or in spite of, the negativity, markets have continued to push higher. After the worst beginning to a year for U.S. stocks in history, the S&P 500 is now up 8% year-to-date through the end of the third quarter. Some refer to this as stocks “climbing a wall of worry”. Negative headlines create uneasiness, resulting in a number of investors sitting on the sidelines while more fully committed investors profit from a generally positive environment – notwithstanding the headlines. Regardless of whether you believe the markets are undervalued, fairly valued, or overvalued, most can agree on one thing: the markets lack euphoria.

It seems the two most pressing concerns keeping a lid on investor enthusiasm are the prospect of the Federal Reserve raising interest rates and the upcoming presidential election. Anytime there is even a whisper of the Fed hiking rates, markets go into full panic mode – ignoring the fact that a quarter point rate increase is largely inconsequential and stocks have historically performed well immediately following a rate increase. According to Goldman Sachs, “In the last 32 policy-rate hike cycles globally, local equity markets gained a median 12% in the 12 months leading up to the start of the new rate cycle.”

As it relates to the election, Wall Street is currently pricing in a Hillary Clinton victory, with Republicans maintaining control of Congress. The consensus is that this would be positive for the markets, because the resulting gridlock in Washington would mean less uncertainty for investors. With a Donald Trump victory, the school of thought is there would be more uncertainty and, therefore, the potential for higher market volatility. Regardless, attempting to handicap the market reaction to either outcome is a fool’s errand. According to Charles Schwab, in the past sixteen election cycles since 1950, the S&P 500 finished positive in the first year of a presidential term only 56% of the time – slightly better than a coin flip. In any event, as an advisory firm serving a diverse group of clients, we typically shy away from political discussions. However, a little humor goes a long way, and given this particularly gut-wrenching election cycle, we will straddle the fence with this:

Whether it’s the Fed, the election, Deutsche Bank, or Syria – the fact is, as an investor, there will always be something to keep you up at night. We are bombarded with headlines 24/7, which magnifies this sense of worry. Investing is not without risk. Risk comes from uncertainty. Uncertainty often comes from headlines. Headlines are never going away. Sir John Templeton, the famed investor and global fund pioneer, said “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” While we certainly do not believe we are in a period of maximum pessimism, we feel equally confident we are not in a period of maximum optimism either. Negative headlines are creating a wall of worry, which has yet to crumble under the weight of euphoria.

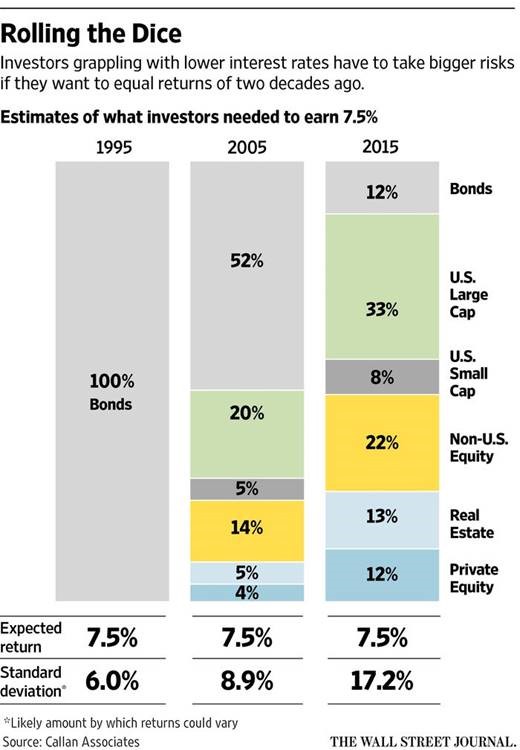

One final note: while investing obviously involves risk, if there is an area of concern right now, it is that investors have to take on more risk than usual to generate returns in this environment. One of the most interesting charts we observed during the quarter came courtesy of The Wall Street Journal:

In order to generate a 7.5% return, investors must now stomach nearly triple the volatility from just two decades ago. Primarily as a result of low (and even negative) interest rates around the world, investors have been forced to pursue riskier investments to achieve the same level of return. Ultimately, this is from where we believe the pessimism, or worry, in the markets stems. While investing never feels entirely comfortable, it feels more uncomfortable than usual right now for many investors. Investors sense the additional risk in their portfolios. The challenge is properly balancing this risk with any potential reward. This is a uniquely personal decision based on each investor’s particular situation. At The ETF Store, we endeavor to properly calibrate the risk in your portfolio and ensure the correct investment plan is in place. We also emphasize controlling investment costs, an important aspect of investing made even more critical in this environment.