Welcome to the ETF Prime Podcast

One of the “most helpful plain-English resources for investors who want to demystify exchange-traded funds” – Bloomberg Businessweek

Latest Episode

Early Grades on 2026 ETF Predictions & Key Market Themes to Watch

Cinthia Murphy, Investment Strategist at VettaFi, delivers early grades on host Nate Geraci’s five ETF predictions for 2026. Matt Bartolini, Global Head of Research Strategists at State Street Investment Management, shares three key ETF and market themes on his radar.

About the Podcast

ETF Prime is hosted by Nate Geraci. Learn how to make ETFs a part of your investment portfolio as Nate spotlights individual ETFs and interviews experts from across the country. ETF Prime is available on Apple Podcasts, Android, Spotify, and most other major podcasting platforms. Specific guest interviews can be accessed by visiting the ETF Expert Corner.

Recent Episodes

Investment Costs: Boring, Confusing, & Absolutely Critical

Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

What gets you more excited? High investment returns or low investment costs? If you are like the vast majority of people, big returns are what really get the juices flowing. We invest our money to earn a return, not to save money on investment costs. At a cocktail party, it is highly unlikely you cozy up to someone and brag, “I just saved 0.5% on my investments!”. That’s a one-way ticket to standing by yourself with a drink in one hand and staring at your phone in the other. The fact of the matter is investment returns thrill and investment costs bore. If something bores us, we tend to ignore it.

Interestingly, outside of investing, we rarely ignore costs. As a matter of fact, most people tend to pay close attention to the money they spend. When shopping for everyday items – groceries, gas, cell phone plans – most people pay at least some attention to costs. I know an executive at a decent sized company who will drive to out-of-the-way gas stations if they can save a few cents on a gallon of gas. I have a rather high-earning friend who diligently clips grocery coupons out of the paper every Sunday and meticulously thumbs through those coupon mailers we all receive. The costs of everyday items add up, so we pay attention.

When it comes to bigger ticket items – TVs, appliances, cars – people tend to pay even closer attention to costs. Have you ever been shopping on Black Friday? People wake up at 4am, wait in long lines, and battle with aggressive shoppers all to save a little money on everything from Fitbits to furniture. In general, the more expensive the item, the more people will comparison shop and negotiate to get the best deal they can. Why is that? Because there is more money at stake. If you think you can save $2,000 on your new car purchase, you will haggle with multiple car dealerships to secure the best deal. You don’t just walk into a store and buy the most expensive TV or pay the sticker price for a new car. You try to find a deal.

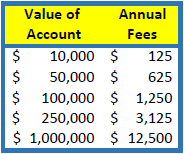

However, when it comes to investment costs, where there is typically even more money at stake, the same behaviors people display when shopping for cable providers or cars seems to go by the wayside. According to the Investment Company Institute, the median cost of an actively managed stock mutual fund, currently one of the most popular investment vehicles, is 1.25% annually. Consider the impact on your investment account:

Keep in mind, these are annual fees – they are charged every single year. Also, the higher the fees you pay, the less money you have to compound over time. In other words, if you can save $500 in annual fees, that $500 is now available to grow over time, year after year. For a $100,000 account, if you could lower your annual fees from 1.25% to 0.25%, you could save $1,000 a year! When was the last time you saved $1,000 on a purchase? Perhaps you waited in one of those Black Friday lines to buy an iPad. Or maybe you saved $5 filling-up a tank of gas or $20 using coupons at the grocery store. Maybe you held off on that glass of wine at the restaurant to save $8 or got rid of some premium channels to save $15 a month on cable. But we are talking $1,000 here!

So why the disconnect?

I think there are several reasons why we pay attention to costs in nearly every other aspect of our lives, but fail to do so with our investments. First, investments do not have readily available price tags like everything else we buy. When you shop for a TV, you can very easily compare the cost of one TV versus another – the price tag is right there. With investments, you may have to do some digging to find the fees. The cynic in me believes that is just the way Wall Street likes it. The more hidden the fees, the easier your hard earned money can be transferred from your pockets to theirs. If the price tag is not right in your face, it is less likely you will consider price when buying investments.

Second, investment costs are automatically deducted from mutual funds and ETFs, which means you never actually see the fees coming out. When you buy a TV, you have to physically swipe your credit card or fork over your cash. You are making a conscious decision to spend your money. With investments, the fees quietly seep out over time. Psychologically, this is an enormous difference. Why do you think federal taxes are withheld from your paycheck each month? It is because the government knows how painful it would be for you to cut a single check every April 15th. Same concept with investment costs.

Lastly, many investors have been led to believe that higher cost equals higher quality – the more you pay for your investments, the better the returns. Across all of the products and services we buy, marketing professionals have spent massive amounts of time and money to ensure we associate higher cost products and services with higher quality. Whether wine, cars, clothes, or electronic gadgets, marketers know exactly how we will respond when presented with two apparently similar options. We tend to think the higher priced options are higher quality. Now, in fairness, there are plenty of examples where higher price does generally equal higher quality – perhaps a five-star hotel or luxury automobile (though, surprisingly, wine isn’t one of them). The saying “you get what you pay for” does have some merit. However, when it comes to your investments, the opposite tends to be true. You get what you DON’T pay for. There is actually an inverse relationship between the costs of your funds and the performance – in other words, the lower the cost of your fund, the higher likelihood of better performance!

So what can you do?

If you invest in mutual funds or ETFs, you are paying an annual fee – something called an expense ratio. When you see “expense ratio”, simply think price or fee. The investment industry has a knack for taking very simple concepts and making them difficult to understand. Expense ratio? Just think price – no different than the prices you see at the grocery store. You can easily find the price of your fund by going to websites like Yahoo Finance, entering the ticker symbol for your fund, and clicking on the profile link. The expense ratio is displayed as a percentage. If you see 0.90%, simply multiply 0.90% by the amount of money you have invested in the fund to find the annual fee (i.e. 0.90% x $100,000 = $900 annual fee). Whether a professional advisor manages your money or you manage your own money, always check investment costs (note that there are other costs besides the expense ratio – loads, 12b-1 fees, commissions, bid-ask spreads, etc). For fun, compare the performance of your fund to its benchmark index as well (which you can also do at Yahoo Finance) – the data tells us that nearly four out of five actively managed funds will underperform.

While the ultimate goal of investing is to generate the required returns for your particular situation, investment costs play a critical role. The higher your investment costs, the higher return you need to overcome these costs. Make a habit of disassociating higher priced funds with higher quality. Most importantly, think about the money you spend for investments in the same way you think about money spent elsewhere – groceries, clothes, entertainment. Most people would not simply throw $1,000 down the drain. You worked hard to save the money in your investment accounts. Make sure you are getting properly rewarded for the money being spent on your investments. While investment costs may be boring and intentionally confusing, lowering costs can lead to more thrilling investment returns, allowing you to be the life of the cocktail party.

Investing in a World with Negative Interest Rates

In a world with negative interest rates, how do you begin to make sense of the investment landscape? Nate & Conor explore the concept of negative rates and offer some takeaways for investors. Kevin DiSano, Chief Portfolio Strategist at IndexIQ, also discusses negative rates and highlights several ETFs to consider in this environment.

Podcast: Play in new window | Download

Institutional Investors Embracing ETFs

Institutional investors continue to increase their use of ETFs. We explain the reasons why and what you can learn from these professional investors. Also, PureFunds CEO Andrew Chanin spotlights ETFs covering cyber security, mobile payment technologies, and big data.

Podcast: Play in new window | Download

StateStreet’s Dave Mazza Spotlights Innovative Technology ETF

Dave Mazza, Head of Research for SPDR ETFs at StateStreet Global Advisors, spotlights the recently launched SPDR FactSet Innovative Technology ETF (XITK). Nate and Conor also discuss the latest buzz coming out of ETF.com’s Inside ETFs conference, the industry’s largest event.

Podcast: Play in new window | Download

New Year, New Investing Strategy: Exploring ETFs

The following was authored by Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy.

If your New Year’s resolution involves learning something new, and your investment portfolio could withstand a new approach, you may want to consider ETFs. Matt Tucker walks you through the basics.

Whether you’re a seasoned investor or new to the markets, I believe the best thing you can do is arm yourself with a little knowledge, learning as much as you can about the present environment and how to navigate it. Like all things in life, a little knowledge goes a long way. Today I’d like to provide a lesson in exchange- traded funds (ETFs).

Let’s start at the beginning: What is an exchange-traded fund?

Exchange-traded funds, or ETFs, were introduced more than two decades ago. During that time, the average investor typically invested in individual stocks, individual bonds, and mutual funds. ETFs provided another avenue for people to participate in the market. The first ETF, and those that followed, were only invested in stocks. More recently, the marketplace introduced bond ETFs as well.

Put simply, an ETF bundles together select securities, such as stocks or bonds. Typically, the goal is to track a market index, such as the S&P 500; when we build ETFs, we look at the index as a guide for deciding which securities to include. The ETF is traded on an exchange, just like a stock. And, just like a stock, investors can buy and sell ETFs throughout the day at a price determined by the market. The price is usually aligned with the collective price of the ETF’s underlying stocks or bonds.

How are ETFs created?

As I mentioned before, when we build ETFs, we typically look at an index as a guide for our investment selection. But who is “we”? “We” are ETF providers, such as BlackRock, who manages iShares funds. When we create a new fund, we first select a particular index. We use that index as a guide for what our new fund will be designed to track. We then launch the fund with a portfolio of securities that is designed to track that index. Large financial institutions called “Authorized Participants”, or “APs”, partner with an ETF provider such as iShares. The AP creates the initial fund shares, and then makes them available to investors.

The AP’s job doesn’t end here. It can also help to keep the ETF’s market price, and the prices of the underlying securities within the fund, closely aligned. They do this by maintaining the balance between supply and demand for the ETF on the exchange. For example, if demand for an ETF increases, its price may go higher than the price of the underlying securities. The AP then would likely seek to take advantage of this by buying those cheaper securities and creating additional ETF shares to sell to the market until demand is met and the prices realign.

If demand for the ETF goes down, and the price drops below the price of its underlying securities, the AP can reduce the number of shares in the market through a process called “redemption”: the AP buys the cheaper ETF shares, unbundles them, and sells the higher-valued securities back into the market until the prices realign. Here’s that scenario, known as “ETF arbitrage”, illustrated via side-by-side comparison:

For illustrative purposes only.

While the buying and selling of an ETF is easy for investors—you simply enter a trade like you would with an individual stock—there’s a lot going on behind the scenes. Financial professionals work together to make this experience simple and seamless.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to the The Blog.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Shares of the iShares Funds may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from the Fund, however, Shares may be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Diversification and asset allocation may not protect against market risk or loss of principal.

When comparing stocks or bonds and iShares Funds, it should be remembered that management fees associated with fund investments, like iShares Funds, are not borne by investors in individual stocks or bonds.

Buying and selling shares of ETFs will result in brokerage commissions.

Although market makers will generally take advantage of differences between the NAV and the trading price of iShares Fund shares through arbitrage opportunities, there is no guarantee that they will do so.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2016 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.