Welcome to the ETF Prime Podcast

One of the “most helpful plain-English resources for investors who want to demystify exchange-traded funds” – Bloomberg Businessweek

Latest Episode

Early Grades on 2026 ETF Predictions & Key Market Themes to Watch

Cinthia Murphy, Investment Strategist at VettaFi, delivers early grades on host Nate Geraci’s five ETF predictions for 2026. Matt Bartolini, Global Head of Research Strategists at State Street Investment Management, shares three key ETF and market themes on his radar.

About the Podcast

ETF Prime is hosted by Nate Geraci. Learn how to make ETFs a part of your investment portfolio as Nate spotlights individual ETFs and interviews experts from across the country. ETF Prime is available on Apple Podcasts, Android, Spotify, and most other major podcasting platforms. Specific guest interviews can be accessed by visiting the ETF Expert Corner.

Recent Episodes

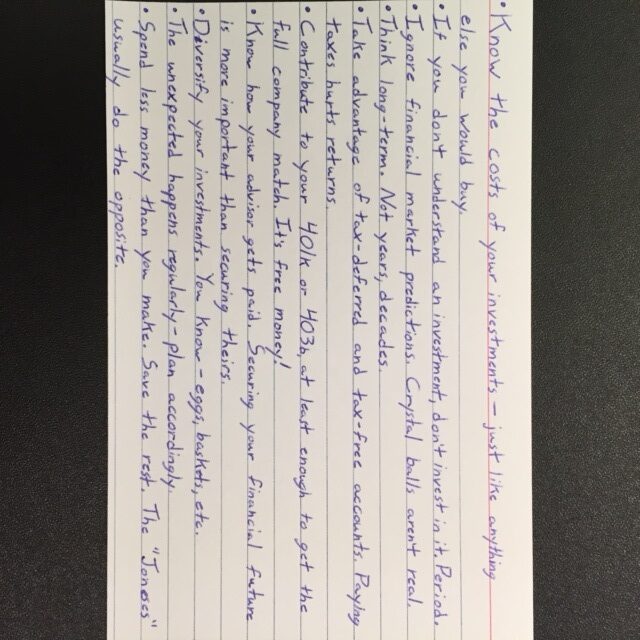

An Index Card with All the Financial Advice You’ll Ever Need

Amazingly, it’s been said the best financial advice can fit on a single index card. In an unnecessarily complicated investment world, we thought this was a wonderful exercise and loved the idea so much, we decided to give it a shot:

What To Do When Financial News Headlines Jump Out at You

The following was authored by Heather Pelant, Personal Investor Strategist at BlackRock

I’ve written about how my aunt calls me when the markets worry her. Needless to say, she’s been calling a lot.

Rising interest rates. Sinking oil prices. A strong dollar and weak earnings. Greece, China and Puerto Rico. The news headlines make hay of these swings, and investor emotions can ride along with the dramatic stories. The stock market will spike one day, you feel optimistic and invest, then the market drops back down the next day.

Earlier this year, we talked about how the markets would seem more volatile than in recent past. Well, they have delivered on that forecast. After years of relative calmness and steadily rising returns, markets have been jumpier lately.

Remain calm and avert your eyes

Turn your gaze away from the headlines, and instead, take a good look at your investments. It is what you do within your portfolio that matters.

Here are four strategies to help your investments navigate the turbulence:

- Diversify. Market cycles typically move in different patterns. I will save you the academic rationale, but you may want to have some investments zig while others zag. This is the crux of what we call diversification. So the most important way to manage portfolio risk overall is to diversify across stocks, bonds, geographic regions and sectors. Getting this mix right is really important. If you’re new to investing, a low-cost way to achieve a balanced portfolio in one single trade is through a diversified iShares Core Allocation exchange traded fund (ETF). If you already have an established portfolio, review your holdings regularly and talk to your financial planner about diversifying.

- Go min vol. If you want broad market exposure with potentially less risk, minimum volatility ETFs might be a good fit . These funds seek to track market indexes with a mix of historically less volatile stocks, so you can still invest in global, U.S., developed international and emerging markets with potentially fewer bumps in the road.

- Bargain shop. Who doesn’t like a good discount? Truth is many U.S. stocks have gotten quite expensive, and it has been harder and harder to find true value. So when the market drops, it can be a great buying opportunity. Talk to your planner about potential deals in the market that can complement your long-term portfolio.

- Stay put. If your investments are in good shape, make no sudden moves. Over time, markets tend to balance out, and you’re likely to do better staying invested in a diversified portfolio than engaging in frenzied, sometimes expensive, trades.

As I do with my aunt, work your way through the four steps above to ensure your investments are sturdy. Successful investors don’t panic over headlines. They stay educated and stay invested. Learn more about what to know and what to do from the mid-year update of The BlackRock List, and get back to enjoying your summer.

Heather Pelant is Personal Investor Strategist for BlackRock. She is a regular contributor to The Blog.

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

The iShares Minimum Volatility ETFs may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful. Diversification and asset allocation may not protect against market risk or loss of principal.

The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2015 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owners.

FactSet’s Dave Nadig on ETF Growth and Innovation

Dave Nadig, Vice President & Director of ETFs at FactSet, discusses ETF growth trends and offers his thoughts on several new ETFs to hit the market. Nate & Conor also explain an eyebrow-raising Wall Street Journal report on mutual fund fees and talk currency values according to the most recent Big Mac Index.

Podcast: Play in new window | Download

Selecting the Right ETFs, Finding Investment Costs, & More…

We answer your questions including how to select the right ETFs for your portfolio and where to find mutual fund and ETF costs. Nate and Jason also spotlight the recently launched O’Shares FTSE US Quality Dividend ETF (OUSA), backed by Kevin O’Leary of ABC’s Shark Tank.

Podcast: Play in new window | Download

The ETF Store Show Moves to New Time, Now Simulcast on 99.3FM

We are excited to announce that, beginning August 4th, The ETF Store Show will air from 3 – 4pm CST every Tuesday. Previously, the show aired from 9 – 10am CST on Tuesdays. Union Broadcasting, Inc., which owns and operates ESPN 1510AM, recently purchased 99.3FM. All ESPN 1510AM programming, including our show, will now be simulcast on the new 99.3FM. This will offer expanded geographical coverage in the Kansas City region, broadening the existing footprint of ESPN 1510AM. Along with these changes, the programming schedule for ESPN 1510AM is expanding with the addition of several new national shows.

The ETF Store Show has enjoyed a wonderful partnership with Union Broadcasting and ESPN 1510AM over the past three years and these changes will allow us to reach even more ETF investors. We will continue to feature guests from across the ETF and investment industry, spotlight innovative ETFs, and offer timely financial market updates. The ETF Store Show has been featured in Money Magazine, and Bloomberg BusinessWeek has called the show one of the “most helpful plain-English resources for investors who want to demystify exchange-traded funds”. We are committed to continue serving as a leading educational resource for ETF investors.

In addition to airing on ESPN 1510AM and 99.3FM, the show will continue to be available online at www.1510.com and TuneIn Radio. If you are unable to listen on Tuesdays from 3-4pm CST, full podcasts of The ETF Store Show can always be downloaded for free at etfstore.com, Apple iTunes, Stitcher Radio, and SoundCloud. All guest interviews are also posted separately in our featured section “ETF Expert Corner” at etfstore.com. Interviews typically run 10 – 15 minutes and can be played directly from any mobile device.

Have a question for The ETF Store Show? We would love to hear from you! Send us your questions and we’ll answer them during the show, including selecting one question to feature as our listener question of the month. To send us your questions, simply click here.