Nate Geraci

April 14, 2020

U.S. stocks experienced their worst first quarter ever, with the S&P 500 dropping nearly 20% as the world grappled with a pandemic. Notably, from its February 19th record high through March 23rd, the S&P 500 shed 34%, the fastest such decline ever. International stocks fared even worse.

Of course, the impact of COVID-19 extends well beyond the stock market realm. The economy has effectively ground to a halt, with many businesses shuttered indefinitely. A record 17 million Americans filed for unemployment over the past three weeks. Our daily lives have been significantly altered. Social distancing, face masks, working remotely, schools cancelled, sporting events postponed… the list goes on. In a short span of two months, we went from “the usual” to “the unprecedented”. We are experiencing an event that grandparents will tell their grandkids about, historians will dissect, authors will pen best-selling books on, and will likely shape future generations to come.

There is actually a name for these types of occurrences: black swans. The theory of black swan events was developed by Nassim Taleb and detailed in his 2007 book The Black Swan: The Impact of the Highly Improbable. Nassim explains:

“First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme impact. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.”

Wikipedia further describes the origins of “black swan”:

“The term is based on an ancient saying that presumed black swans did not exist – a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild.”

In short, black swan events are unexpected, rare, and have profound impact. Black swan events are also nearly impossible to predict, though a key characteristic is the belief by some that the events could have been foreseen. Recent examples of black swans include the 9/11 terrorist attacks and the 2008 global financial crisis.

We typically know a black swan when we see one… but only then. The COVID-19 outbreak clearly meets the criteria: it’s rare (most have never experienced a global pandemic), unexpected (did anyone predict this at the beginning of the year?), and will most certainly change the way we live. That’s not to say some haven’t warned of a “super virus” outbreak with potentially dire consequences. However, there’s a reason kids were attending school in February, you were working at the office or going about your normal daily life, and sporting venues were packed: the VAST MAJORITY of people didn’t anticipate the severe impact of COVID-19, even after reports began circulating out of Wuhan, China. True to black swan form, there are some “Monday morning quarterbacks” now claiming they saw this coming. We don’t recall seeing those people practicing social distancing or wearing face masks at the time. Plus, it’s not overly healthy for the global economy to operate as though the next pandemic, world war, or other catastrophe is always right around the corner. Nevertheless, the black swan has appeared.

The Question is, “What Comes Next?”

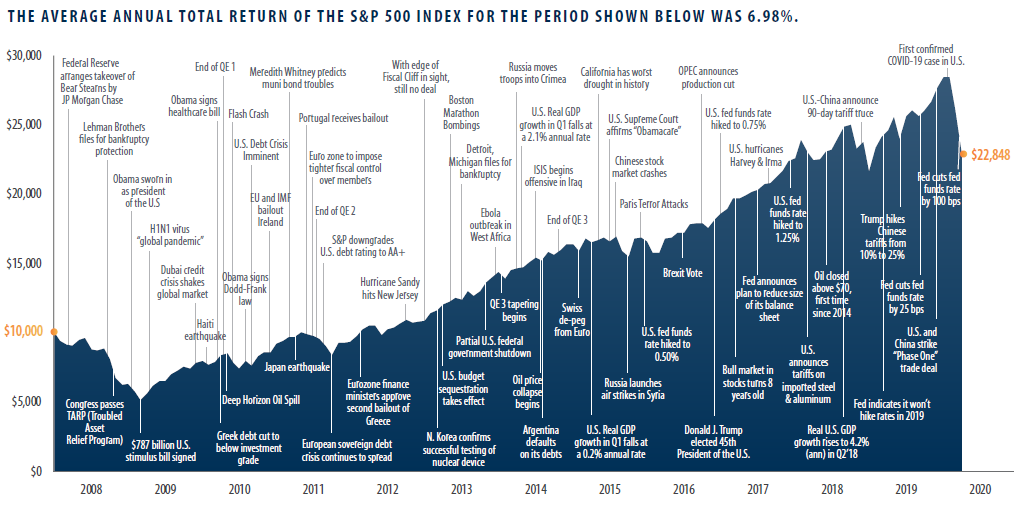

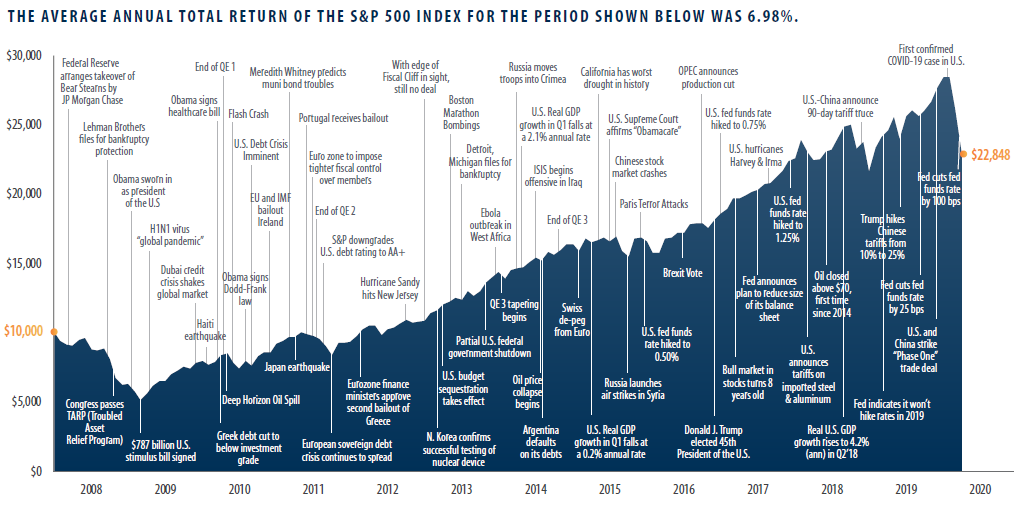

Last quarter, we described the multitude of events since the last black swan (2008 financial crisis): Greek bailout, U.S. debt downgrade, European sovereign debt crisis, “fiscal cliff”, Cyprus banking crisis, “taper tantrum”, Ebola virus, Syria, Chinese currency devaluation, Brexit, 2016 U.S. Presidential election, trade war, and many more. The below chart depicts these events, with the S&P 500 as a backdrop:

Source: First Trust

Two important points from this graphic: 1) Note the resiliency of the stock market (and economy), which recovered from the last black swan event in relatively short order, and 2) Black swan events are unpredictable. More than a few of the events shown above were feared at the time as potential black swans. However, outside of the financial crisis, we wouldn’t characterize any of these as true black swans. Which is the point. Nobody knows when a black swan will show itself or which direction it will swim once it appears!

In fact, as of the time of this writing, the S&P 500 has advanced nearly 25% since its March 23rd low, including recently closing out its best week since 1974. So far in the second quarter, the S&P 500 is up 13%. The Federal Reserve has taken unprecedented actions to support the economy and financial markets. That includes the purchase of bond ETFs, which nobody would have anticipated two months ago. Congress passed a massive fiscal stimulus package including sending cold, hard cash to most Americans. Both stock market bulls and bears are having a difficult time handicapping what happens next.

In late February, as the Coronavirus situation initially began unfolding, we said:

“The question is whether this situation will be transitory or more prolonged? The fact is, nobody knows. There are other variables at play besides the virus. U.S. stock market valuations are on the higher end. While valuations are poor shorter-term market timing tools, they can inform us about the prospects for longer-term returns. After a significant up move last year, perhaps stocks needed a breather – and they were looking for any reason. What will the Federal Reserve and other central banks do? Central banks have shown a strong willingness to provide support (lowering interest rates, providing liquidity, etc.). 2020 is also an election year. President Trump is running on a platform which includes a strong economy. The last thing he wants to see is an economic disruption. How might that factor into the equation?”

Since that time, we now know the Federal Reserve and other central banks will do whatever it takes to keep the economy and stock market afloat (you could argue in reverse order). Stock market valuations have come down, but there is no visibility into what corporate earnings might hold over the next several quarters. That only reinforces valuations as poor short-term timing tools. As for the election? That’s anyone’s guess, though we know the current administration is committed to getting things back to normal as quickly as possible. Which leads us back to the question, “Is this situation transitory or more prolonged?”.

The best answer likely comes down to science. A vaccine is the only sure-fire solution to the COVID-19 economic problem and is still almost certainly months away. In the meantime, more testing, better treatments, and growing immunity (from those already infected) will start to build confidence, slowly allowing us to return to normal. The faster confidence is built, the quicker the economy will get back on track.

Reopening the economy after a pandemic will no doubt be challenging. While the economy may have turned-off like the flip of switch, it won’t come back on so easily. That said, we have been here before, from the Great Depression to World Wars to the Global Financial Crisis. Black swans have visited us in the past and will certainly swoop down in the future. And we will always show resiliency and recover.

From an investment standpoint, we have taken great care to construct portfolios and investment strategies which react in a known manner to unknown events. While we cannot predict black swans, we always expect the unexpected. Diversification and proper risk calibration are key tools helping prepare for the unexpected. Diversification provides portfolio resiliency when black swans do appear. Proper risk calibration for your unique situation helps provide investor resiliency. The lack of portfolio surprises is highly important to us, as it allows optimistic long-term investors to do what they do best: stay on track.