Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

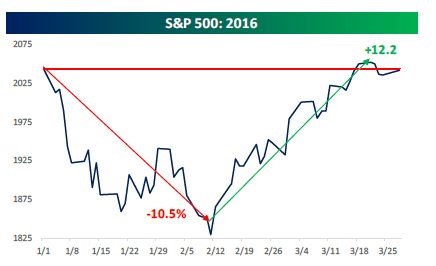

The first quarter of 2016 was historic. After the worst selloff to begin a year in history, with the S&P 500 ultimately plunging nearly 11%, stocks reversed course and staged an equally historic rally. The S&P 500 bottomed on February 11th and subsequently gained 12%+ in just seven weeks to finish the quarter positive and within shouting distance (3.5%) of its all-time record high. If you were too busy during the quarter to open an account statement or check the financial news, you were none the wiser (and likely much less stressed as well).

Source: Bespoke

When “historic” is used to describe stock market action, it likely grabs your attention as an investor. The S&P 500 has existed in its present form since 1957 and in three months, we witnessed the worst start to a year in nearly 60 years, followed by a rapid, unprecedented V-shaped recovery. However, some context is warranted, particularly as it relates to the 10%+ downside move. The historical significance of the market’s first quarter drop lies in the timing of the declines occurring at the start of the year, rather than the severity of the losses. Market corrections, defined as declines of 10%+, are actually rather commonplace (as are 10%+ up moves). Since 1957, S&P 500 corrections have occurred nearly every one and a half years on average. This most recent market correction simply coincided with a historically rough start to the year, along with a bevy of frightening headlines.

China, the Fed, oil, corporate earnings, terrorist attacks – the headlines came fast and furious, kicking the already ambitious financial media into high gear as stocks struggled out of the gate. The constant 24/7 news barrage often times came with apocalyptic predictions. Some selected headlines from various outlets:

- “Marc Faber: Asset Markets Will Crash Like Titanic” – January 6th Bloomberg

- “Sell everything! 2016 will be a ‘cataclysmic year,’ warns RBS” – January 12th CNN Money

- “A recession worse than 2008 is coming” – January 15th CNBC

The headlines alone were enough to make seasoned investors sweat! Perhaps all of the above will come to pass – no one can know for sure – but had you heeded these headlines in the short-term and exited the markets, you would have missed the subsequent recovery. Investors, indeed, went to cash in droves during January and many likely missed the ensuing up move. Two better options may have been to either fully participate in the market’s roller coaster ride or not participate in the sharp declines to begin with – more on that in a moment.

As it relates to news headlines, one of the single biggest challenges confronting investors today is up-to-the-second news and information available on demand. Ben Carlson, author of A Wealth of Common Sense noted, “anyone with a smartphone today has better mobile phone capabilities than the president of the United States did 25 years ago. We have better access to information than the president had 15 years ago”. While more information is usually a positive (think car shopping or home buying), investing is one of the few areas where more information can negatively impact behavior. The reason is simply the more information we have, the more we feel like we need to use it. Doing something – anything – gives us a feeling of control. When markets see-saw as they did during the first quarter and we are bombarded by negative headlines, our natural human instinct is to seize control. The conundrum is that the future is unknowable and uncertain – you cannot control it. However, you can control your own behavior, significantly increasing the chances of investment success.

Focus on Your Goals, Not News Headlines

Controlling investor behavior is certainly easier said than done. Emotions drive behavior and it is difficult to remove emotion when contemplating how to invest your hard-earned money. So what can you do? Recently, Donald Bennyhoff, senior investment analyst at Vanguard, offered perspective we believe perfectly captures how investors should approach investing in this, or any, environment:

“At times, the temptation to react or do something can be very strong. Sometimes, the headlines are dire—economic challenges or global strife—and our very human fight-or-flight instinct seems overwhelming. But are these the headlines that matter most as investors try to achieve their goals? Perhaps we can best help investors by explaining that the headlines they should pay attention to are the headlines of their lives, not the headlines in the news.”

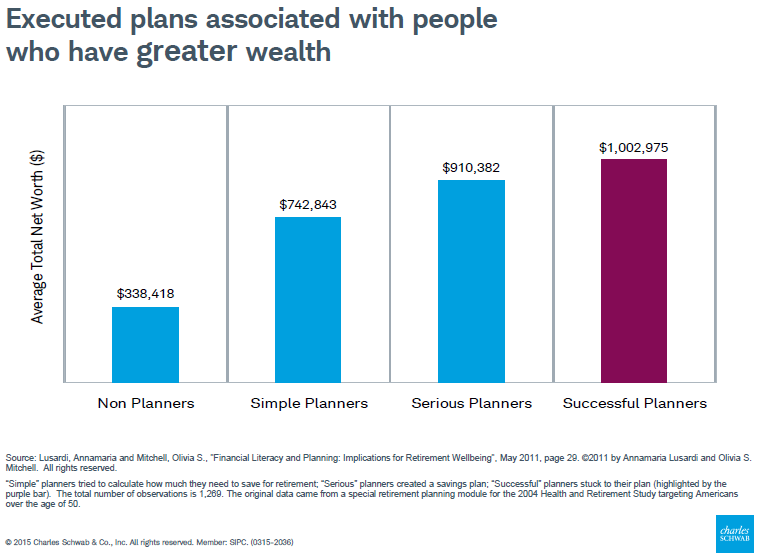

Simply put, the best way to control behavior is having a plan, the right plan, in place. The right plan is one based on the headlines of your life, not the headlines in the news. Different investors should have different plans. Everyone has their own unique life headlines.

Perhaps you are approaching retirement and cannot afford a 10%, let alone a 20%+, decline in your portfolio. In that case, you should be positioned more conservatively and/or have an appropriate risk management strategy in place. That would likely have prevented you from experiencing the 10%+ first quarter decline and the associated negative emotions. Maybe you are a high-earning, younger, aggressive investor saving for retirement. A stock-heavy buy & hold portfolio might be just the right fit. Your experience during the quarter would have been sharply up and down, but you have 25 years until retirement – 10% up and down moves are part of the deal to capture the long-term returns you desire.

Regardless of your situation, a plan tailored to your distinctive headlines neutralizes emotion and positions you for financial success:

A Plan Can Only Work When Used

Remember, having a plan is only one part of the equation. You also have to stick with the plan. Boxing legend Mike Tyson once said “Everyone has a plan until they get punched in the mouth”. Mike Tyson won 50 fights with 44 knockouts because he punched the other fighter in the mouth and they abandoned their plan. They became rattled, went away from their game plan, and it was “lights out”. The same holds true with your investment portfolio. Negative events are going to happen with the markets – that is one of the few guarantees in investing. Develop the right plan, be prepared for the punches, and have confidence in your plan.

We recently came across a wonderful quote courtesy of The Motley Fool’s Morgan Housel: “If investing were easy, everyone would be successful. And if everyone were successful, there would be no more opportunity to exploit. So it’s never going to be easy, and a lot of people will always be unsuccessful”. Renowned investor Warren Buffett often says “investing is simple, but not easy”. One of the most difficult aspects of investing is simply sticking with your game plan. At The ETF Store, our emphasis is on designing the right plan for your specific situation and serving as your sounding board. We focus on the headlines of your life, not the headlines in the markets. Our well-researched, time-tested, disciplined investment strategies are tailored to your situation. Regardless of the market environment, our goal is make investing easier so you can succeed.