Stocks and bonds were down during the quarter as interest rates resumed their upward march. The 10-Year U.S. Treasury yield surged from 3.88% to 4.59% over the past three months. It began the year at 3.79% and, at the time of this commentary, has further soared to 4.66%. As we have noted previously, higher interest rates impact everything from mortgages to auto loans to credit cards. Increased rates also make financing more expensive for businesses, who borrow money to pay for daily operations and invest in longer-term projects. All of this can have the effect of slowing the economy since consumers and businesses spend less when faced with higher rates. A slowing economy can negatively impact corporate earnings, potentially reducing stock prices.

Furthermore, as interest rates rise, bonds begin looking more attractive relative to stocks. Some investors may decide to sell stocks to purchase those higher-yielding bonds. That increased competition from bonds places selling pressure on stocks – particularly, longer duration growth stocks whose anticipated earnings are much further out into the future. Not only that, but stock valuations are still elevated. Even after the recent decline, the S&P 500 sports a forward price-to-earnings ratio of 17.8 versus an historical average of 16.5. The combination of elevated valuations, potentially reduced corporate earnings, and investors gravitating towards bonds has led to the recent downdraft in stocks.

As it pertains to bonds, recall that their prices move in the opposite direction of interest rates. As rates go up, the prices of bonds fall. A simple example is to consider owning a bond with a $1,000 face value that pays 4% annually. If interest rates go to 5%, then why would an investor buy a bond paying only 4%? The answer is, they wouldn’t – unless that bond cost less than $1,000. Therefore, the price of the 4% bond falls to a value that offers the equivalent of a 5% yield. This is exactly what we witnessed this past quarter. The bottom line is that rising interest rates have pressured both stocks and bonds recently.

The Fed, Inflation, and a “Soft Landing”

Last quarter, we said the following about the stock market’s performance through the midway point of the year: “This year’s stock rally might not be everything that it seems.”

Specifically, we noted: “2023 has already produced plenty of potential negative catalysts that could have or should have added to the sour sentiment. The Fed has hiked rates three times this year, with more increases likely on the way. Inflation remains sticky. The yield curve is more deeply inverted than at any point over the past 40+ years, a classic recession indicator. There was the aforementioned regional banking crisis, which included several of the largest bank failures the country has ever experienced. There was another testy debt ceiling showdown in Congress. A year-and-half following Russia’s invasion, the war in Ukraine is still escalating. Yet, none of this has seemed to matter to stocks.”

Since that time, there has been yet another Fed rate hike, a clumsy game of chicken amongst lawmakers over a potential government shutdown, and the United Auto Workers strike. There is also now a tragically escalating situation in the Middle East.

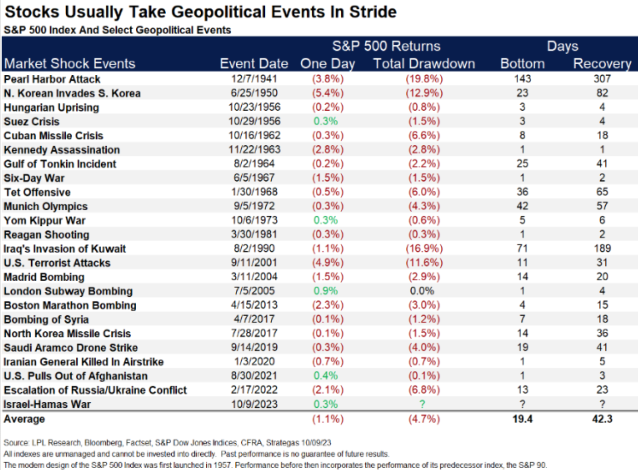

As an aside, we would like to offer a quick note on stock market performance and geopolitical events. For investors concerned that the Israel – Hamas conflict may lead to severe market declines, history shows otherwise. In response to major geopolitical events, on average, stocks have lost only 4.7% and recovered that loss within 42 days. That doesn’t mean events such as the Israel – Hamas conflict can’t impact financial markets, even for more prolonged periods of time. They most certainly can and do, though not typically in predictable ways.

Source: LPL Financial Research

How many investors expected a positive stock market less than one year removed from the attack on Pearl Harbor? The point is that these types of events should be way down the list of investor worries.

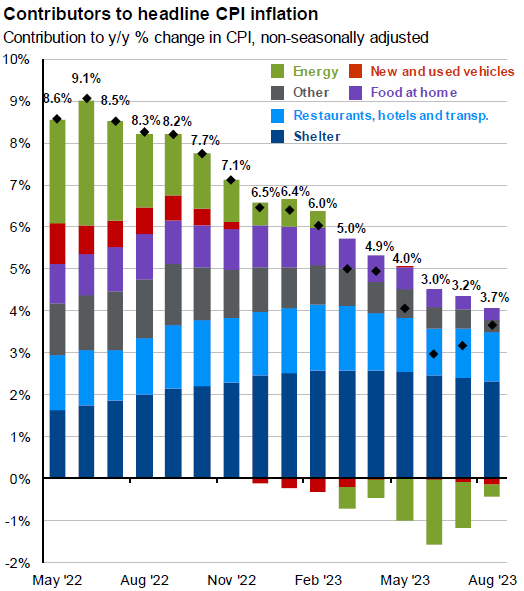

Of more importance to investors right now is the Fed and their ability to orchestrate a “soft landing”. Simply put, the Fed is attempting to rein in inflation without causing a recession. In other words, the Fed is intentionally trying to slowdown the economy to reduce inflation. However, they want to avoid slowing the economy so much that it enters a recession. In an effort to accomplish this, the Fed has aggressively raised the discount rate from near zero to an upper bound range of 5.5% over the past year-and-a-half. Their efforts are paying-off as the economy has shown signs of cooling, with the labor market decelerating and inflation coming down fairly substantially. However, inflation still remains elevated and above the Fed’s 2% target.

Source: J.P. Morgan Guide to the Markets

At the most recent Fed meeting in September, Chairman Jerome Powell stated: “The process of getting inflation sustainably down to 2% has a long way to go.”

He added: “The worst thing we can do is to fail to restore price stability, because the record is clear on that.”

The takeaway is the Fed remains committed to tackling inflation, meaning interest rates could remain higher for longer – which brings us back to where we began this commentary.

What Does This Mean for Investors?

Interest rates are clearly the key market driver at the moment, but they are simply a reflection of investor sentiment on the economy, inflation, and to a lesser degree – rising debt levels (which can impact longer-term yields). While rising rates can cause shorter-term market disruptions, there are several points we believe are important to reiterate for longer-term investors.

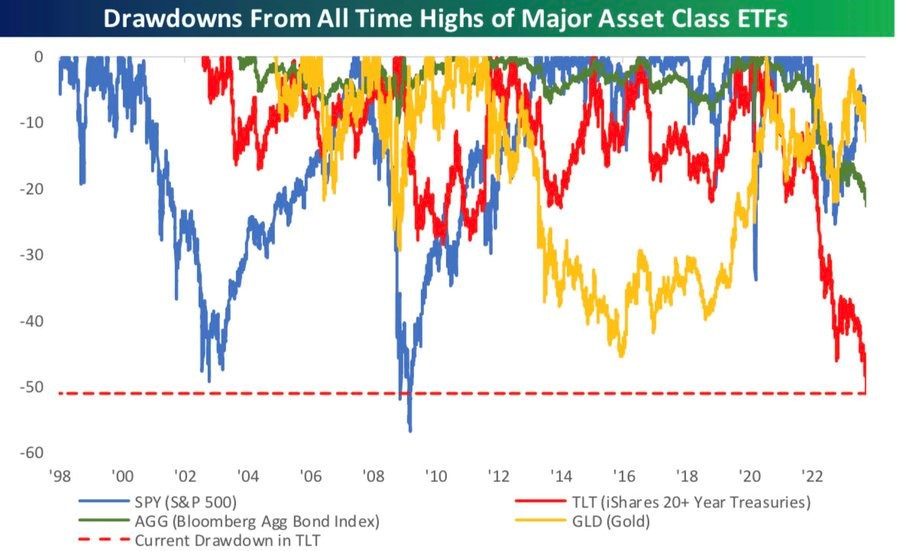

Exactly one year ago, we noted the following: “There are now real, meaningful opportunities to generate reliable portfolio income, something that has been nearly impossible to do unless investors have been willing to chase riskier yields. This last point bears special mentioning, as we view bonds as a portfolio ballast and we have been well-positioned – all things considered. Our diversified fixed income portfolio has been comprised of shorter duration and higher quality bonds, along with investment grade floating rate notes and Treasury Inflation Protected Securities (TIPS). These holdings have helped buffer against the overall bond carnage, providing at least some refuge in this remarkably atypical market environment.”

The takeaways are simple: 1) Rising interest rates mean bond investors can now generate real income in their portfolio, and 2) Our diversified, conservative positioning in bonds has been extremely prudent. Note this chart of historic drawdowns, where a drawdown is a peak-to-trough decline during a specific time period for an investment. Now consider that a portfolio of 20+ Year Treasury Bonds (i.e. longer duration) is down more than 50%(!), which is greater than the drawdown in stocks during the bursting of the dotcom bubble.

Source: Bespoke Investment Group

We have avoided taking that type of duration risk in our portfolios, along with generally shunning lower credit quality issues. While there is reinvestment risk when holding shorter-dated bonds (meaning you may have to invest maturing bonds at lower rates – assuming rates decline), we believe it is more important to avoid allowing bonds to severely damage a portfolio (as 20+ Year Treasuries have). For certain investors, it very well might make sense to lock in longer-term higher yields if they are planning on holding the bonds until maturity. However, that approach is typically limited to situations where an investor needs to match maturing bonds with specific future liabilities.

Regarding stocks, we believe it is important to reemphasize our time-tested, longer-term approach. While the goal of this commentary is to share our views on the current market environment, it is absolutely critical for investors to remain squarely focused on the longer-term. Despite rising rates and a cascade of negative headlines this year, stocks are still positive! If rates start to come back in, it is entirely possible stock investors could further benefit. If the Fed executes a “soft landing”, corporate earnings could remain strong and stocks buoyant. Regardless, we will continue focusing on the areas we have certainty and control over: global diversification, disciplined investment management, lower fund costs, tax efficiency, and most importantly – understanding your unique financial goals. As always, our team of advisors is here to help answer your questions. Please don’t hesitate to reach out to your advisor at any time to further discuss the markets or your portfolio.