Nathan Geraci is President of The ETF Store, Inc. and host of the weekly radio show “The ETF Store Show“.

If there was one word to describe the third quarter, it would likely be “tense”. Geopolitical tensions continued to escalate in the Middle East and Eastern Europe, with both the terrifyingly rapid rise of ISIS and Russia’s Putin intent on rekindling a Cold War. Meanwhile, the Federal Reserve remained walking a delicate tightrope of removing economic stimulus and prepping investors for interest rate increases, all without spooking the market. As if that were not enough, there was growing talk of “bubbles” and “nosebleed” stock valuations from market watchers and academic types, sending a shiver up the spines of nervous, “once bitten, twice shy” investors. With Halloween right around the corner, it is no surprise investors conjured up all sorts of frightening images of ghouls and goblins wreaking havoc in their investment portfolios.

The textbook definition of “tense” is“a state of mental or nervous strain”. Tension usually results from uncertainty. When the future is uncertain (think about an employee working for a company just announcing a round of layoffs or an individual facing a significant health scare), tensions naturally rise as we attempt to determine how the situation may unfold. As it relates to the financial markets, tension derives from that same uncertainty and if there is one thing the financial markets absolutely despise it is uncertainty. Markets like clarity, whether that clearness paints a positive or negative picture, financial markets like knowing what they are dealing with. When there is uncertainty, tensions rise which inevitably leads to volatility as financial markets grapple to find clarity. That brings us back to the most recently completed quarter.

Uncertainty over geopolitical events, the Fed, and stock market valuations all contributed to a tense environment and volatility did, in fact, noticeably increase. One measure of market volatility is something called the VIX, also referred to as the “fear index”. This is what volatility in the 3rd quarter looked like:

While the VIX is much closer to its all-time lows than its all-time highs, you can see the spikes during the quarter. Another way to think about this chart is that it depicts the emotions you feel as an investor –this captures the anxiety of market ups and downs. When volatility enters the market, this is the moment when investors are truly put to the test. This becomes gut-check time. It is relatively easy being an investor when market pullbacks are shallow and volatility is benign, but what happens when you experience sharp and sudden declines? We will get to that in a moment, but first, a few points regarding the three most direct causes of recent volatility in the markets: geopolitical events, Federal Reserve policy actions, and stock market valuations:

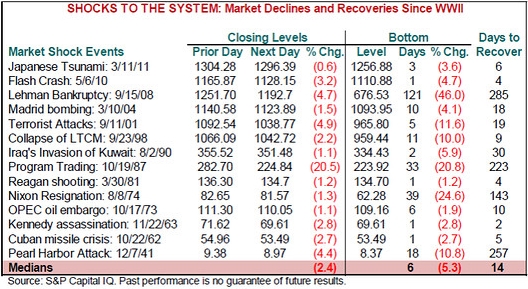

Geopolitical Events. With the situations in Syria/Iraq and Ukraine, it is helpful to consider how stocks have reacted historically to past military confrontations, political events or other similar scenarios. The below analysis from S&P Capital IQ offers a nice snapshot of stock market reactions to various unanticipated shocks (“including wars and near wars, assassinations and attempts, terrorist attacks, and financial collapses”). The data paints a compelling picture. After the initial event, which resulted in a median stock market decline of 2.5%, stocks found a bottom in only six days and all losses were recouped in just 14 days. For investors concerned that current geopolitical events may lead to severe market declines, history shows there is not much to be afraid of here:

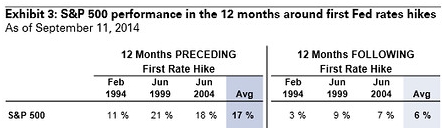

Federal Reserve Policy Actions. As it relates to uncertainty over Fed policy tightening, interestingly, while investors fret that a rise in interest rates will result in steep stock declines, history tells us a different story. While stock returns certainly are not as high following a rate increase as they are leading up to a rate increase, there is hardly cause for concern. The following abbreviated chart courtesy of Goldman Sachs Global Investment Research and The Wall Street Journal shows that for the three most recent Fed rate increases, the S&P 500 has averaged a 17% gain in the 12 months leading up to the increase and a 6% average gain in the 12 months after an increase. While stock market returns are clearly lower than prior to Fed rate hikes, again, there is nothing overly frightening about positive returns:

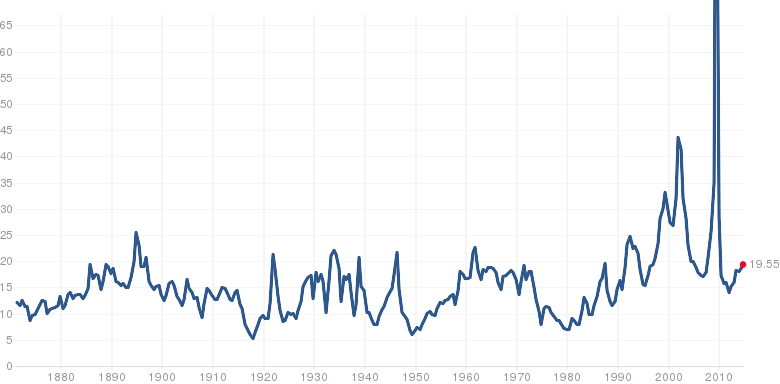

Stock Market Valuations. As for the bubble talk, well, this is one area that might merit at least some concern and was a subject we touched on last quarter. The trailing 12-month price-to-earnings ratio stands at just below 20:

While this is not as high as at some previous market tops, it is higher than the 15.5 historical average. There are countless ways to measure stock valuations and all have their shortcomings, but the logical conclusion to draw from this basic measure is if you think about the probabilities of future returns, stocks will likely offer lower returns moving forward than they have been in the past – that does not necessarily mean negative, just lower than what we have seen previously. So what do you do as an investor?

While history may not repeat itself, it does often rhyme. There is no guarantee on how geopolitical events or Fed rate increases may impact the markets moving forward, but history shows us it is typically best not to overreact to these situations. Also, while news headlines may lead to volatility in the markets, volatility in and of itself is not necessarily a bad thing – it depends upon your perspective. For longer-term investors, volatility can provide an opportunity to acquire investments at lower prices. With proper portfolio rebalancing and strategic portfolio adjustments, volatility can actually be a positive for investors. It is also important to remember that volatility is really just a measure of uncertainty or risk in an investment. Over the long-run, you should expect to receive higher returns in stocks because they are riskier assets. The higher return is your reward for stomaching the higher risk and volatility. It is the reason why Treasury bills have returned 3.5% annually since 1926, while large-cap stocks have returned 10.1%. Lastly, as it relates to volatility, it should also be noted that the longer your investment time horizon, the more volatility declines. According to Morningstar, Inc., from 1926 to 2013, on an annual basis, large-cap stock returns have ranged from -43% to 54%. For a five-year period, the average return range tightens to -12% to 29%. And for even the worst 20-year holding period during this time, average returns ranged from 3% and 18%. As for potentially elevated stock valuations, the best defense continues to be diversification. Diversification not only helps dampen portfolio volatility, but it can allow you to capitalize on areas of the financial markets that may offer more favorable probabilities for higher future returns. While diversification may not have worked as well recently as it has in the past, again, history often rhymes and the merits of diversification have been shown time and again.

As we discussed earlier, volatility in the markets comes from tension, which is the result of uncertainty. While you cannot remove the uncertainty (nobody knows what Putin may do next), you can relieve the tension. The first thing you have to do is acknowledge it. Investing is stressful and does create tension – and that is completely rationale and normal. But tension can also lead to emotional decisions and potentially bad investment behaviors. By acknowledging the tension, you can better evaluate your position as an investor and avoid poor decisions. If the tension and stress caused by your investments is excessive, it may be time to reevaluate your risk tolerance and consider a more conservative investment approach. Otherwise, try to embrace the tension and volatility; view it as an opportunity. Through portfolio rebalancing, an understanding of the risk versus reward characteristics of your investments, and a focus on your long-term goals, you can avoid the potential pitfalls volatility creates for more frazzled investors.